1. Have you ever wondered what your investment's actual annual growth rate is?

Hello, friend! I'm the site administrator. Today, I want to discuss a question every investor faces.

Let's start with a true story about my friend "Xiao Ming." Several years ago, Xiao Ming enthusiastically invested $5,000 in the stock market, buying shares of a tech company he strongly believed in. The market has been volatile, and three years later, that investment is now worth $8,000 in his account. He's pleased, but a question arises: "How much did this investment earn me on average each year?"

His initial calculation was straightforward: a total gain of $3,000 over three years meant an annual gain of $1,000, yielding an average annual return of 1,000/5,000 = 20%. He was thrilled by this figure for quite some time. But when I explained that this "simple average" calculation was actually highly misleading, his face filled with confusion.

Have you ever felt this confusion? Watching the fluctuating numbers in your account, you want to grade your investment performance but don't know which yardstick to use for the fairest, most accurate measurement. That's precisely the core issue we're tackling today. In this article, I'll share with you, without holding back, how to use the powerful tool of Excel to accurately calculate your investment's "Compound Annual Growth Rate" (CAGR) using an extremely simple formula. More importantly, I'll also reveal an alternative method that's faster and more convenient than manual calculations. Trust me, after reading this article, you'll bid farewell to "Xiaoming-style" confusion and gain a fresh, professional understanding of measuring investment returns.

2. What is CAGR? Why is it ten thousand times better than a "simple average"?

Before we dive into the practical steps, allow me to take a moment to explain, in the most accessible terms, what CAGR actually is and why it matters so much. I believe this part holds even greater value than learning the formula itself, as it helps build the right mindset for investment analysis.

CAGR stands for Compound Annual Growth Rate. Don't let the name intimidate you—its core concept is straightforward: it calculates a "smoothed" annualized return rate, assuming consistent growth each year, to show how an investment grows from its initial value to its final value.

What's the fundamental difference from "simple averaging"? Let's look at an example of a mistake I made early in my investing journey. I recall when I first entered the market. I invested $1,000. The first year, the market soared by 50%, and my account value jumped to $1,500. I was ecstatic! However, the next year, the market corrected, and my investment lost 50%. My account value was cut in half, dropping from $1,500 to $750.

Now the question arises: what was my average annualized return over these two years?

If calculated using "simple averaging": (50% in Year 1 + -50% in Year 2) / 2 = 0%. It seems like I neither gained nor lost? But my principal clearly dropped from $1,000 to $750—a tangible loss of $250! This 0% result is clearly wrong; it's misleading.

If calculated using CAGR: It reveals that turning $1,000 into $750 over two years equates to a steady annual loss of approximately 13.4%. While this negative figure is jarring, it accurately reflects my investment outcome.

See the difference? The simple average method overlooks the power (or drawback) of compound interest—it fails to account for how each year's gain (or loss) is calculated based on the new base value from the previous year. CAGR, however, captures this core principle. It paints a smooth growth curve from start to finish, smoothing out all the sharp fluctuations in between. This is why nearly all professionals and authoritative institutions use CAGR—not simple average growth rates—when evaluating multi-year investments like funds, stocks, or real estate. It's more honest, more accurate, and better reflects an investment's true long-term performance.

3. The "Magic" Formula for Calculating CAGR in Excel

Alright, now that we've covered the theory, let's roll up our sleeves and see how to calculate CAGR in Excel, our most frequently used tool. You'll be surprised to find that such a simple formula underpins this seemingly sophisticated concept.

Its standard mathematical formula is:

CAGR = ((Ending Value / Beginning Value) ^ (1 / Number of Years)) - 1

Let's break down each part of this formula to ensure you fully grasp its meaning:

Ending Value: This is the total value of your investment at the end of the measurement period. In Xiao Ming's example, it's $8,000.

Beginning Value: This is the total value of your investment at the start of the measurement period. In Xiao Ming's example, it's $5,000.

Number of Years: This is the total number of years in the entire investment period. In Xiao Ming's example, it's 3 years.

The "^" symbol: In Excel and most programming languages, this represents ‘exponentiation' or "power operation."

The final "-1": Since the preceding calculation yields a multiplier like 1.15, subtracting the principal 1 gives the net growth rate—such as 0.15, or 15%.

In my view, the most beautiful aspect of this formula is its intuitiveness. (Ending Value / Beginning Value) calculates the total growth multiplier. The step ^(1 / Number of Years) essentially applies a "geometric mean" or "Nth root" to this total multiplier, ‘distributing' it evenly across each year. This captures the essence of "compounding." Unlike a crude, simple average that sums and divides by N, it elegantly handles compound interest through exponentiation and root extraction. Once you grasp this, the formula transforms from a cold string of characters into a tool brimming with logical beauty.

4. Step-by-Step Guide: Calculating CAGR in Excel in Four Easy Steps

"Knowledge gained from books is always superficial; true understanding comes from hands-on practice." Now, let's open Excel and follow along step by step to calculate Xiao Ming's case. I promise this process is far simpler than you imagine.

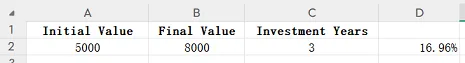

4-1: Step 1: Set Up Your Data

Open a blank Excel worksheet. For clarity, start by creating a simple header row.

In cell A1: Initial Value

In cell B1: Final Value

In cell C1: Investment Years

This practice is excellent—it ensures you instantly understand each number's meaning even when revisiting the sheet months later.

4-2: Step 2: Enter Your Investment Data (Enter the POWER Formula)

Now, enter Xiaoming's case data into the corresponding cells below the header.

In cell A2: Enter 5000

In cell B2: Enter 8000

In cell C2: Enter 3

4-3: Step 3: Enter the Core POWER Formula

This is undoubtedly the most critical step in the entire process! We will "translate" the formula we learned earlier into a language Excel can understand. In Excel, we can use the POWER function, which makes the formula clearer. Of course, using the ^ symbol directly is also perfectly acceptable.

Select an empty cell, such as D2, then enter the following formula in the formula bar:

=((B2/A2)^(1/C2))-1

Pay close attention: The outer parentheses and the parentheses around (1/C2) are absolutely critical! I'll explain why in detail in the next section. After typing, press Enter.

4-4: Step 4: Format the Result as a Percentage

After pressing Enter, you might see a decimal in cell D2, such as 0.1695.... This number is the calculated CAGR, but it's hard to read. We need to convert it into the percentage format we're accustomed to.

The process is straightforward:

1. Select cell D2.

2. Click the "Home" tab in Excel's top menu bar.

3. In the "Number" section, simply click the "%" symbol.

Look! 0.1695... instantly transforms into 16.96% (Excel automatically rounds the value). Now you can confidently tell Xiao Ming that his $5,000 investment achieved a compound annual growth rate of 16.96% over the past three years. This figure is far more accurate and professional than the 20% he calculated himself.

5. "Pitfall Guide": The 3 Deadly Mistakes Most Commonly Made When Calculating CAGR

Among the many investor friends I've encountered, I've noticed that even when people know the formula, there are still several "pitfalls" they tend to fall into. Trust me, understanding these in advance can save you hours of debugging and rework down the road. This section could be considered the "hidden value" of this article.

Mistake #1: The Misunderstanding Trap About "Number of Years"

This is by far the most common error! Suppose an investment runs from the end of 2020 to the end of 2023. Many instinctively assume this spans 4 years (2020, 2021, 2022, 2023) and thus record the "number of years" as 4. This is completely wrong!

Remember: CAGR measures the number of "time periods," not the number of "time points."

From the end of 2020 to the end of 2021 is the 1st period (1 year).

From the end of 2021 to the end of 2022 is the 2nd period (1 year).

From the end of 2022 to the end of 2023 is the 3rd period (1 year).

Therefore, the total investment period is 3 years, not 4. A simple formula is: Number of Years = End Year - Start Year. Never count the number of years again! I once made this simple mistake, causing my entire portfolio return analysis to skew until I discovered it during a quarterly review—that feeling was absolutely awful.

Mistake #2: The Forgotten Parentheses—Excel's "Tyranny" of Calculation Order

Remember how I emphasized the importance of parentheses earlier? This is no exaggeration. Excel strictly follows mathematical precedence rules (exponentiation first, then multiplication/division, followed by addition/subtraction). If you accidentally enter a formula like B2/A2^1/C2-1, guess how Excel will calculate it?

It will first calculate A2 raised to the power of 1 (which is still A2), then divide B2 by that result, divide the outcome by C2, and finally subtract 1. This is miles away from the calculation logic you intended!

The correct formula ((B2/A2)^(1/C2))-1 uses parentheses to explicitly direct Excel like a commander, specifying each step:

1. (B2/A2): First calculate the total growth factor.

2. (1/C2): Then calculate the reciprocal of the number of years.

3. (...) ^ (...) : Perform the exponentiation operation to "annualize" the growth factor....

4. ....- 1: Finally, subtract the initial principal of 1 to obtain the net growth rate.

So treat parentheses as the "traffic cops" in your formula—they ensure your calculation logic flows smoothly and accurately.

Error #3: Misuse of Negative Numbers and Zero

CAGR is a tool for measuring "growth rate," meaning it may not perform well in certain specific scenarios.

If the initial value or final value is negative (e.g., a company transitions from loss to profit), the CAGR formula may return an error due to taking the square root of a negative number, or yield a figure with no practical economic meaning. In such cases, CAGR is not a suitable metric, and you may need to consider alternative financial indicators like variations of Return on Investment (ROI).

If the initial value is zero, the expression (final value / 0) in the formula triggers a "#DIV/0!" division-by-zero error. Logically, a growth rate starting from zero is infinite, which is mathematically meaningless.

Understanding these limitations enables you to use CAGR more professionally, avoid drawing erroneous conclusions in unsuitable scenarios, and ultimately make wiser judgments.

6. Awesome! But... Is There a Faster Way?

By now, you've mastered the "dragon-slaying skill" of calculating CAGR in Excel. This skill is undoubtedly powerful and useful, allowing you to deeply customize your investment analysis spreadsheets.

But let's be real. As investors, our time is precious and our energy limited. In fast-moving markets, you might be quickly screening dozens of stocks or needing to instantly share an investment's annualized performance during a discussion. Do you really have time to open Excel, create a new sheet, input formulas, and check parentheses every single time?

I'll be honest—I don't.

More often than not, I just need an instant, accurate answer. I don't want to recall formulas or worry about cell references going wrong. I just want to input the three most critical numbers—initial value, final value, number of years—and get that CAGR I need right away.

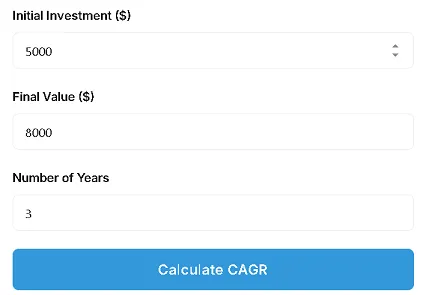

Driven by this simple, genuine need, my team and I developed this tool on our website: a pure, fast, no-brainer online CAGR calculator.

6-1: Built for Efficiency: Our Instant Online CAGR Calculator

This tool embodies the philosophy of "ultimate simplicity." We stripped away all unnecessary features—no complex charts, no annoying ads, no registration steps. It's like the most reliable calculator on your desk, existing for one purpose: to deliver answers instantly when you need them.

What are its advantages?

1. No formula memorization: Never worry about mistyping ^ as * or forgetting the final -1.

2. Zero setup: No Excel spreadsheets, no tables to create—just open the page and go.

3. Lightning-fast results: Enter three numbers, click once, and see the answer instantly.

4. Cross-platform access: Calculate anytime, anywhere—whether on your computer, tablet, or phone.

Now, I invite you to experience this "instant result" thrill firsthand. Click the link below and try our earlier example with Xiao Ming (initial amount 5000, final amount 8000, years 3). See if it delivers that familiar 16.96% in under a second.

>> Click Here to Experience Our Free, Lightning-Fast Online CAGR Calculator! <<

This tool is my answer to my own needs as an investor—and the value I hope to offer you. It doesn't replace your ability to perform deep analysis in Excel; instead, it aims to be your reliable assistant in daily investment research, saving you significant time.

7. Dive Deeper: Advanced CAGR Applications

Now that you've mastered the basics and experienced its convenience, let's explore CAGR's advanced applications. This section will equip you with insights far beyond the average investor when discussing investments.

7-1: How to Calculate CAGR for Non-Whole Years (e.g., 3.5 Years)?

Real-world investments rarely span exact calendar years. You might buy mid-year and sell several years later. For instance, how many years span from June 30, 2020, to December 31, 2023?

Excel handles this elegantly. It subtracts the dates directly to find the number of days. Then, dividing that by the average days in a year (typically 365.25 to account for leap years) yields the precise number of years.

The process is as follows:

Enter the start date in cell A2: 2020/6/30

Enter the end date in cell B2: 2023/12/31

Enter the formula in cell C2: =(B2-A2)/365.25. You'll get an exact number of years like 3.50...

Then, you can plug this precise number of years into our previous CAGR formula for calculation.

Our online calculator also supports fractional years. So if you calculate an investment period of 3.5 years, simply enter 3.5 in the "Number of Years" field—it handles it perfectly.

7-2: What is a "Reverse CAGR Calculator"? How does it benefit you?

This is a fascinating concept at the core of many financial planning tools. Conventional CAGR looks "backward," showing past performance. Reverse CAGR, however, "looks forward." It answers the question: "What CAGR do I need to achieve to reach a specific wealth goal by a future date?"

For example, You currently have $100,000 and aim to grow it to $500,000 through investing within 10 years to achieve your initial financial freedom goal. What CAGR do you need?

This question can be solved using Excel's RATE function, but it's slightly complex for beginners. This is precisely where a "reverse CAGR calculator" or "investment goal calculator" comes in handy. It instantly tells you that to achieve this goal, your portfolio needs to achieve a compound annual growth rate of approximately 17.46%.

What's the use of this number? It provides you with a clear, quantifiable "benchmark." When selecting investment products, you can use this 17.46% as a benchmark. Ultra-conservative products with historical CAGRs far below this may not suit you, while those promising annualized returns of 30% or 40% should raise red flags about potential hidden risks. It transforms your investment decisions from "gut feelings" into "goal-driven, evidence-based choices."

7-3: The Limitations of CAGR You Must Know

As your friend and a responsible advisor, I must tell you that while CAGR is powerful, it is far from a panacea. Ignoring its limitations can lead you to make erroneous judgments.

1. It's a "silent" metric: CAGR only reveals the smooth growth rate between start and end points, but it completely obscures the bumpy road along the way. Two funds with identical 10% CAGRs could represent one with steady annual growth between 8% and 12%, while the other might have endured rollercoaster swings like +40% one year and -20% the next. For investors with low risk tolerance, the latter is clearly the worse choice. Therefore, CAGR must be used alongside other volatility measures, such as standard deviation.

2. It assumes profits are reinvested: CAGR's "compounding" nature inherently assumes 100% of your annual returns are reinvested the following year. But if you withdraw dividends annually for spending, your actual return rate will inevitably fall below the calculated CAGR.

3. It cannot predict the future: This point cannot be overstated. Historical CAGR, no matter how high, is absolutely no guarantee of future performance. It is merely a tool for evaluating past results and should never be treated as a crystal ball for forecasting the future.

Recognizing these limitations allows you to approach this tool with a clear and respectful mindset.

8. Your Exclusive Benefit: CAGR Calculation Cheat Sheet

To help you reinforce today's learning anytime, anywhere, I've prepared a single-page PDF cheat sheet just for you. It includes:

The core Excel formula for CAGR

A streamlined flowchart of the four-step method

Warnings about three common mistakes

Key points on CAGR's limitations

This cheat sheet is like a pocket-sized personal coach. Print it to stick beside your monitor, or save it on your phone for quick reference anytime.

9. My Personal Perspective and Insights

After covering so many technical aspects, I'd like to share some philosophical thoughts on CAGR as a tool. In my view, its true value extends far beyond simply yielding a percentage figure. At its core, it offers us ordinary people navigating the uncertain investment world a mindset that "simplifies complexity and focuses on the long term."

Markets fluctuate daily, saturated with noise: one sector surges today, another concept heats up tomorrow. If we fixate on these short-term swings, our emotions easily get carried away, leading to irrational decisions like chasing highs and selling lows. CAGR acts like noise-canceling headphones, filtering out this daily clamor and forcing us to extend our view to three, five, or even ten-year cycles. This allows us to assess an asset's true, intrinsic growth potential. Once you adopt CAGR thinking, you won't panic over a single day's decline or get carried away by a single day's gain. Your mindset becomes calmer and more stable because you're tracking that smooth growth curve that cuts through bull and bear markets, not the daily "ECG" of price fluctuations.

Moreover, I believe CAGR is a powerful ally against "human weaknesses." Human nature tends to remember recent events, a phenomenon known in investing as "Recency Bias." If a fund just had a stellar year, we easily overestimate its capabilities; if it recently underperformed, we're quick to dismiss it entirely. CAGR forces us to examine the full history by "compressing" years of data into a single, impartial metric—rather than judging based on partial, recent memories. It reminds us that exceptional investing stems from long-term consistency, not short-term sprints. So the next time you calculate an investment's CAGR, take an extra minute to ponder: What's the long-term story behind this number? Does it align with your investment philosophy? That, perhaps, matters more than the number itself.

Summary, Actionable Recommendations & Risk Warning

10. Your New Skill & Your New Tool: Summary & Action

Friend, thank you for reading this far. Today, I believe your takeaways are threefold:

1. A new skill: You've mastered how to accurately calculate CAGR in Excel and learned to avoid common pitfalls.

2. A new tool: You've discovered our simple, fast online CAGR calculator and bookmarked it as your reliable assistant.

3. A new mindset: You understand CAGR's deeper meaning, its limitations, and have learned to evaluate investment returns through a longer-term lens.

Now, I urge you to take immediate action:

Practice Now: Find a real investment case of your own—whether stocks, funds, or other assets—and manually calculate its CAGR using Excel.

Bookmark the Tool: Add our **Online CAGR Calculator** to your browser favorites, making it part of your daily research routine.

Share the Knowledge: If you found this article helpful, consider sharing it with friends who also invest. Helping others is also a form of gain.

11. Final Reminder: Important Compliance and Risk Disclosure

Before concluding, I must emphasize with utmost seriousness:

Disclaimer: All information and tools provided herein are for educational and reference purposes only and do not constitute any form of financial or investment advice. CAGR calculations exclude taxes, transaction costs, inflation, and other factors. Past performance is no guarantee of future results. All investments involve risk, including the potential loss of principal. Consult a qualified financial professional before making any investment decisions. You are solely responsible for your financial choices.

References:

Investopedia. (2023). Compound Annual Growth Rate (CAGR): What It Is, Why It's Used, and How to Calculate It.

Leave a Comment: