1. The Ultimate Guide to Calculating Trading Profits (Mastering Leverage and Short Positions)

Hey, fellow market warriors!

I'm the site admin. Before diving into today's topic, I want to share a real-life story that still makes my cheeks burn.

I remember it clearly—a Friday afternoon in June 2018. With just 10 minutes left before the U.S. market closed, I was on a high. I went all-in with 50 shares of NVIDIA at $245 per share using 3x leverage. By the close, the stock had soared to $253, showing a $400 floating profit in my account! I spent a perfect weekend basking in the glow of victory. But when I opened the market screen bleary-eyed that Monday morning, my heart sank instantly—the stock had fallen back to $248, and my account now showed a $300 loss.

Why? I had closed the position at a profit! The answer: Trading fees and overnight margin interest had devoured every penny of my profit, plunging me into the abyss of loss.

That day, I realized for the first time: if you don't calculate your "true profit," even a winning trade can end up as a loss. It was this painful experience that later drove me to create the "Profit/Loss Calculator" you see today.

So, if you've ever been confused by the profit/loss figures in your account, this article is for you. Let's thoroughly understand every detail behind "profit."

Important Risk Warning

Before we begin, allow me to remind you as a friend and fellow trader: This article and all calculators provided on this site are intended solely for educational and informational purposes. They do not constitute any financial, investment, or trading advice. All trading examples (such as NVIDIA) are used solely to illustrate calculation methods and do not represent any buy or sell recommendations. Trading financial markets, especially with leverage, involves significant risk and may result in the loss of all or more than your initial investment. Past performance does not guarantee future results. Before making any investment decisions, conduct thorough independent research and consult a qualified financial advisor. Always prioritize the safety of your capital as the paramount rule of trading.

2. The Foundation of All: Calculating Profit for a Standard "Long" Trade

Before diving into exciting complex scenarios, we must first lay a solid foundation. Just as martial arts training begins with mastering the horse stance, understanding the most fundamental profit calculation method helps you verify the accuracy of any tool and provides deeper insight into the composition of "profit." For the most common "long position" trade—what we often call "buying low and selling high"—the profit calculation is remarkably straightforward.

The core formula is:

Net Profit = (Total Sale Amount - Total Purchase Amount) - Total Transaction Fees

Sounds simple, right? Let's break it down to ensure every detail is crystal clear:

Total Sale Amount: Calculated as Sale Price × Number of Shares. This represents the total funds flowing into your account after liquidating the shares.

Total Purchase Amount: Calculated as Purchase Price × Number of Shares. This is the total funds that initially flowed out of your account to acquire these shares.

Total Transaction Fees: This is the most easily overlooked yet critically important component for beginners! They act like tiny "bloodsuckers," quietly eroding your profits. They typically include, but aren't limited to, commissions for buying and selling, platform fees, and transaction taxes.

Let's examine a concrete example. Suppose you purchased 50 shares of Apple stock at $170 per share, with your broker charging a 5% commission. Later, you sold these shares at $195 per share, again paying a 5% commission.

1. Total purchase cost: $170/share × 50 shares = $8,500

2. Total sale proceeds: $195/share × 50 shares = $9,750

3. Gross profit (before fees): $9,750 - $8,500 = $1,250

4. Total transaction fees: $5 (buy) + $5 (sell) = 10

5. Final Net Profit: $1,250 - 10 = 1,240

This process isn't difficult, but it requires careful attention to detail and thoroughness. For simple trades, manual calculations might still work. However, if your trades become slightly more complex, you'll find traditional methods quickly fall short.

3. Digging Deeper: Why Most Online Calculators Disappoint

After recognizing the limitations of basic calculations, your first instinct might be to search online for a more powerful tool. Yet you'll soon encounter a frustrating reality: the vast majority of so-called "stock profit calculators" available are essentially just online versions of the basic formula we covered in the previous section. They can't handle "short selling," know nothing about "leverage," and certainly don't account for "partial position building."

It was precisely through experiencing these frustrations firsthand that I resolved to create a tool truly designed for modern traders. Before introducing it, let me guide you through the concepts that trip up ordinary calculators.

4. The Art of Short Selling: How to Calculate Profits from Price Declines?

Short selling—a strategy that shines in bear markets. Its logic is the exact opposite of going long: you anticipate an asset's price will fall, so you "sell high and buy low," profiting from the difference.

The formula for calculating short-selling profits is essentially the "reverse" application of the basic formula:

Net Short Profit = ((Entry Price - Exit Price) × Position Size) - Total Transaction Costs

Entry Price: The price at which you initially "sold" the stock (high price).

Exit Price: The price at which you later "bought back" the stock (low price).

For example, if you shorted 200 shares of a stock at $50 and closed the position at $30 with total fees of $20, your net profit would be (($50 - $30) × 200) - $20 = $3,980.

But I must also sternly warn you: Shorting carries far greater risk than going long. When going long, your maximum loss is your entire principal. When shorting, the stock price can theoretically rise indefinitely, meaning your potential loss is unlimited! Therefore, short trades must be paired with strict stop-loss strategies.

5. The Double-Edged Sword: Incorporating "Leverage" into Your Calculations

Leverage allows you to use a smaller margin to execute a trade far larger than your principal. It amplifies both your profits and losses by the same multiple. The painful lesson I shared in the introduction is the most vivid illustration of leverage's power.

A simplified way to understand it:

Leveraged Return ≈ Market Price Change (%) × Leverage Multiple

To give you a more intuitive sense, I simulated three outcomes for the same trade under different leverage levels using real test data:

| Scenario Description | Entry Price (USD) | Exit Price (USD) | Shares | Leverage | Net Profit (USD) | Margin-Call Price (USD) |

|---|---|---|---|---|---|---|

| No Leverage | 200 | 210 | 100 | 1× | +959 | — |

| 2× Leverage | 200 | 210 | 100 | 2× | +1,959 | 100 |

| 5× Leverage | 200 | 210 | 100 | 5× | +4,959 | 160 |

See the huge difference? A 5% market gain yields nearly $5,000 profit with 5x leverage—but it also means your position gets liquidated and you lose everything if the market drops just 20% (from 200 to 160)! A profit calculator that doesn't factor in leverage is dangerous—it creates a serious misunderstanding of your actual trading risk.

6. Say Goodbye to Guessing: Introducing Your All-in-One Profit/Loss Calculator

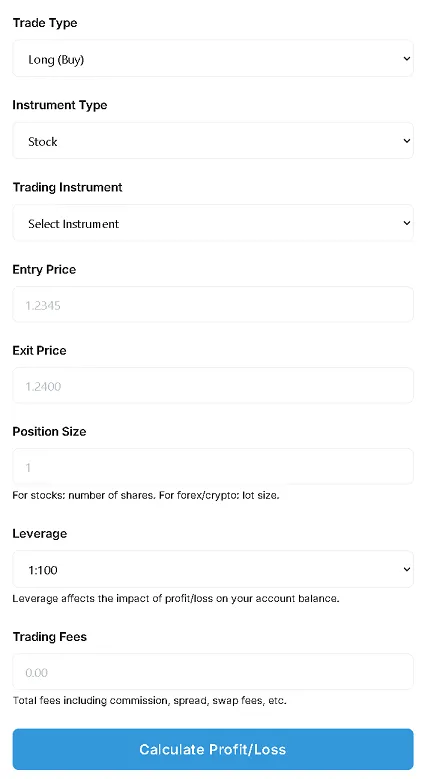

Friends, theory is essential, but what we traders need most is a practical tool that delivers fast, accurate answers in a market where every second counts. Today, I'm proud to introduce our website's core tool—the Profit/Loss Calculator.

Stop guessing! Calculate your real trading profits instantly.

This free tool helps you:

✅ Calculate both long and short trades

✅ Factor in leverage

✅ Include all transaction fees to reveal net profit

6-1: Parameter Breakdown: Why Every Input Field Matters

Many beginners ask: "I just want to know my profit—why fill in so much?" Let me explain with one of my favorite analogies:

Imagine your trade is a mountain expedition:

Trade Type (Long/Short): Determines whether you're climbing upward or exploring downward.

Instrument Type: Tells you whether the mountain is a stock or an ETF.

Entry/Exit Price: Your starting and ending coordinates for this expedition.

Position Size: The weight of your backpack.

Leverage: Like attaching rocket boosters to your backpack.

Trading Fees: The toll booths you must pass along the way.

Neglect any of these, and your navigation might lead you into a ditch. Especially leverage and trading fees—many calculators default to 100x leverage or zero fees, which can severely distort results. Always input your actual figures.

6-2: Mobile Experience: Designed for Real Trading Scenarios

My wife once complained, "Typing these tools on a landscape phone screen is exhausting." That comment sparked an idea. So I purposefully built this calculator with a responsive design. In portrait mode, each input field occupies a full row, letting your thumb tap effortlessly without awkward contortions.

I recall sharing a screenshot of this design on social media and receiving overwhelmingly positive feedback. One comment stood out: "This is fantastic—I finally don't have to let go of the subway handrail to calculate my stock profits." That's exactly what I aimed for—a tool that seamlessly integrates into your life and remains convenient in any situation.

7. Advanced Scenario: How to Calculate the Average Cost for "Batch Position Building"?

Experienced traders rarely go "all in" at once. We prefer buying in batches at different price points to average out costs. This is where you need to calculate your Weighted Average Price (WAP).

Average Cost = Total Purchase Amount / Total Number of Shares Purchased

For example, if you bought 100 shares of NVIDIA in three batches totaling $90,200, your average cost is $902 per share. This $902 becomes your true "benchmark" for calculating future profits and losses.

8. Don't Let It Devour Your Profits: Understanding Hidden Costs

Beyond commissions, you must also be wary of hidden costs like spreads, overnight fees (swaps), and slippage. I've analyzed SEC Form 606 reports from major brokers and found their fee structures vary significantly. You must act like a detective to understand your broker's fees and factor them into the "Trading Fees" section of our calculator.

9. Become a smarter trader: Key considerations for every decision-maker

9-1: Realized vs. unrealized profits: Don't mistake paper gains for victory

Remember: Nothing is real until you close your position. Our calculator shows your "realized profit" after closing trades. Don't get hypnotized by fluctuating paper gains in your account—strictly follow your trading plan.

9-2: Tax Considerations: Your Profit is Pre-Tax

Profits earned from trading are subject to "capital gains tax" in most countries/regions. Our calculator displays pre-tax profits. For clarity, I've compiled the 2025 U.S. federal short-term capital gains tax rates (for single filers) based on IRS data:

| Taxable Income (Single) | 2025 Short-Term Capital Gains Tax Rate |

|---|---|

| $0 – $11,600 | 10 % |

| $11,601 – $47,150 | 12 % |

| $47,151 – $100,525 | 22 % |

| $100,526 – $191,950 | 24 % |

| $191,951 – $243,725 | 32 % |

| $243,726 – $609,350 | 35 % |

| $609,351 + | 37 % |

Friendly reminder: I am not a Certified Public Accountant (CPA). The above data is sourced from IRS Publication 550 (2024 edition). For detailed information, consult a professional tax advisor or visit the IRS official website.

10. Beyond Profit Calculation: Build Your "Smart Trading Workflow"

A successful trader spends more time "looking ahead." I encourage you to combine our tools to build a "smart trading workflow":

1. Pre-Trade (Risk Planning): Use our "Risk/Reward Calculator" to ensure the potential reward justifies the risk.

2. Pre-Trade (Position Sizing): Use our "Position Sizing Calculator" here to calculate precise trade sizes based on your risk tolerance.

3. Post-Trade (Performance Review): Use today's star tool—the "Profit/Loss Calculator"—to review your actual gains or losses.

Additionally, I strongly recommend adopting a tip I've used for years: Create a physical self-check card with questions like "Am I at risk of a margin call? " and "Are my trading fees exceeding 2%?" Stick it on your monitor. Quickly review it before every order—this keeps you constantly vigilant.

11. My Personal Perspective and Insights

In my view, the most compelling aspect of trading isn't the thrill of making money, but the clarity of "knowing why you profit and why you lose." I've seen too many people share profit screenshots on social media while remaining silent about commissions, taxes, and leverage risks. This is disrespectful to trading and to the hard-earned money involved.

Truly professional traders break down every gain and loss to two decimal places. They relish the process of transforming market uncertainty into a controllable, repeatable mathematical problem through knowledge and discipline.

My motivation for creating this calculator is simple: the next time I make a mistake, at least I'll instantly and clearly know where I went wrong. If you also believe "understanding" is more important than "leaving it to chance," then let's work together to transform trading into a craft that can be continuously refined—not a gamble on guessing market movements.

12. Summary & Actionable Recommendations

1. Bookmark this page: Use it as your "Trading Calculation Knowledge Base."

2. Try the Tool: Open our Profit/Loss Calculator now and test it with your most recent trade data.

3. Explore the Toolbox: Check out other calculators on our website to start building your own intelligent trading workflow.

13. Recommended Reading

To help you build a more comprehensive trading knowledge system, I've also prepared the following in-depth articles:

Stock Market Profit Calculator: Long & Short with Leverage, Fees & Stop-Loss

All-in-One Position Size Calculator: Stocks, Crypto, Futures

Forex Leverage & Margin Calculator: Calculate Risk, Avoid Margin Calls

14. Final Risk Disclosure

1. No Investment Advice: All content you read or calculate on this website is for general educational purposes only. I am not a licensed financial advisor, and the calculator does not consider your personal circumstances. You should seek independent advice before trading or investing.

2. Leverage Amplifies Losses: Leveraged products can magnify losses just as quickly as they amplify gains. Minor adverse price movements may trigger margin calls or forced liquidations, resulting in losses exceeding your initial deposit. Industry best practice is to risk ≤ 2% of total capital per trade, and beginners are advised to limit leverage to 2x-3x.

3. Market & Liquidity Risk: Prices fluctuate sharply and may skip stop-loss levels, especially outside major trading hours. Illiquid stocks or contracts may be difficult to close at displayed prices.

4. Technical and Operational Risks: The calculator operates within your browser; results depend on your input. Typos, rounding errors, or outdated fee data may produce inaccurate figures. Always manually verify calculations at least once before committing funds.

5. Psychological Risks: Behavioral finance research indicates that large, rapid losses impair decision-making and may trigger "revenge trading." Step away from the screen if you feel emotionally charged.

6. Regulatory Restrictions: The FCA, ESMA, SEC, and many Asian regulators have imposed leverage limits or even banned crypto derivatives for retail clients. Ensure the products you intend to use are legally available in your jurisdiction.

7. Tax Implications: Profits may be subject to capital gains tax or income tax depending on your residency and holding period. Consult a qualified CPA or tax attorney; tax examples on the website are for illustrative purposes only.

15.Citations:

Internal Revenue Service (IRS). Topic 409, Capital Gains and Losses.

Leave a Comment: