1: Precise Profit/Loss Calculator: How Professional Traders Calculate Forex and Options P&L Including Fees

Hello, my friend!

Have you ever had this experience? After closing a trade that seemed “profitable,” you excitedly open your account dashboard only to find the balance increase falls far short of your expectations. In that moment, confusion and frustration wash over you: “Where did my profits go?”

I remember it vividly. Early in my trading career, around 2015, I executed what I thought was a brilliant short-term trade on GBP/USD. The chart showed I'd captured nearly 50 pips of profit. Based on my calculations at the time, that should have been close to $200 in gains. But after closing the position, my account balance had only increased by less than $150. That missing $50 felt like a thorn lodged deep inside me. After frantically digging into the details, I realized I'd completely overlooked trading commissions, overnight interest, and even a bit of unfriendly slippage.

That experience taught me a brutal lesson: in the trading world, the “gross profit” you see and the “net profit” that actually ends up in your pocket are two entirely different things.

From that day on, I became obsessed with precisely calculating the “True Net P&L” for every single trade. I realized this wasn't just nitpicking over numbers—it was about objectively evaluating my trading strategies and ensuring my long-term survival in this market. Yet most articles and tools either overemphasize theory or deliberately gloss over those “inconvenient” costs.

This is precisely why I'm writing this comprehensive guide for you today. I will share with you, without reservation, the comprehensive framework I've developed over the years—from calculation to management. Together, we'll demystify those “hidden costs” and learn how to leverage the simple yet powerful calculators on our website to precisely control every trade you make.

The goal of this article isn't to turn you into an accountant, but to make you a smarter, more professional trader with greater control over your account.

Compliance & Risk Disclosure:

Before we dive in, please allow me to state unequivocally: This content is for educational purposes only and does not constitute financial or investment advice. All calculator results on our website are based solely on your input and cannot predict future market movements. Trading financial markets involves high risk and may not be suitable for all investors. Before making any trading decisions, carefully consider your investment objectives, experience level, and risk tolerance. Remember, past performance does not guarantee future results.

2: Basic P&L Formula vs. “True Net P&L”: The Mental Shift from Amateur to Professional

In our trading journey, nearly everyone starts with an extremely simple formula. This formula itself is not flawed, but it paints an overly rosy and incomplete picture. What truly enables you to run farther in the marathon of trading is another, more comprehensive and realistic formula. I believe grasping the difference between these two represents the first critical leap from amateur to professional thinking for traders.

2-1: A Simple Start: The Basic P&L Formula (Where Most Stop)

When you first learn to calculate profit and loss, you'll likely encounter this formula:

Basic P&L = (Sell Price - Buy Price) × Position Size

For short trades, it becomes:

Basic P&L = (Opening Price - Closing Price) × Position Size

This formula is straightforward and intuitive. It quickly shows you the “gross profit” or “gross loss” generated by price movement in the trade, without accounting for any additional costs. For example, suppose you bought 10 shares of a company's stock at $150 and sold them at $160.

Basic P&L = ($160 - $150) × 10 shares = $100

Looks pretty good, right? You made $100. So you happily close your trading platform, thinking you've completed another successful trade. However, this is often where misunderstanding begins. In the real trading world, this $100 gross profit must pass through layers of “extraction” before what truly belongs to you remains. In my view, relying solely on this formula to evaluate performance over the long term is akin to a company focusing only on its operating revenue while ignoring operating costs, taxes, and interest expenses—the final financial statements will inevitably look grim. This mindset fosters a false sense of optimism about your trading abilities, leading you to take unnecessary risks down the road.

2-2: The Professional Perspective: Introducing “True Net P&L” (Our Core Metric)

Now, let's put on the glasses of a professional trader and examine the formula that truly determines the changes in your account balance. I call it “True Net P&L,” the core metric in my trading system.

True Net P&L = Basic P&L - Transaction Fees - Overnight Interest ± Slippage Impact

This formula may seem complex, but trust me—it's worth its weight in gold. It exposes every “devilish detail” that impacts your final returns. Let's compare them visually with a table:

| Characteristic | Basic P&L | True Net P&L |

|---|---|---|

| Calculation | Profit/loss from price movement only | Price movement + all transaction costs |

| Reality Reflected | Idealized, incomplete picture | Actual changes in account balance |

| Psychological Impact | May lead to overconfidence or unclear reasons for losses | Enables objective strategy evaluation and maintains composure |

| Suitable For | Absolute beginners, for conceptual understanding | All serious traders aiming for long-term profitability |

Let's revisit the stock example. Suppose you paid your broker a total of $5 in transaction fees ($2.50 each for buying and selling) to complete this trade. Your “True Net P&L” would then be:

True Net P&L = $100 (Basic P&L) - $5 (Transaction Fees) = $95

See? Your profit instantly shrinks by 5%. For a small trade, this might seem insignificant. But imagine you're a frequent day trader executing hundreds of trades per month. These overlooked costs add up to a staggering figure. They could even determine whether your entire month ends in profit or loss. Embracing the concept of “true net profit/loss” means you start treating your trading like running a business. You'll start focusing on cost control and strategizing how to boost the “net profit margin” of each trade. This is the true path to consistent profitability.

3: Deconstructing Your Trading Costs: The “Secrets” Your Broker Won't Tell You

To calculate “true net profit/loss,” we must act like detectives, uncovering every hidden cost embedded in the trading process. These costs fall into three main categories: trading fees, overnight interest, and slippage. Like the submerged portion of an iceberg, they aren't always obvious but tangibly impact your trading vessel.

3-1: Trading Fees & Commissions

This is the most direct cost. Every time you execute a trade, your broker charges a service fee. This fee primarily takes two forms:

1. Spread: The most common cost in forex trading. There's always a difference between the Ask (buy) price and the Bid (sell) price you see—this spread is the broker's profit. For example, if EUR/USD is quoted at 1.0850/1.0852, the 2-pip spread represents your transaction cost. Your position starts with a “micro-loss” the moment you open it.

2. Commission: For certain account types (like ECN accounts) or when trading stocks/options, brokers may charge a fixed or percentage-based commission on top of the spread. Examples include $7 per standard lot traded or $0.01 per share.

How to address this? You must clearly understand your broker's fee structure. Is it pure spread-only, or “spread + commission”? Is the commission charged on a single-sided basis (only when opening or closing a position), or double-sided (charged on both opening and closing)?

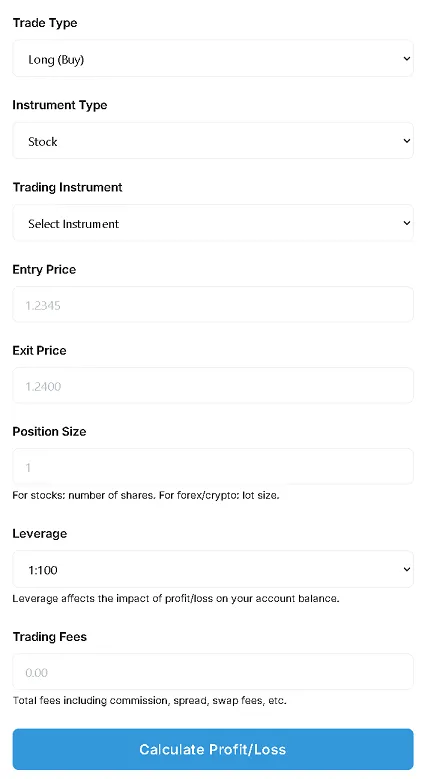

This is precisely where our website's Profit/Loss Calculator shines. Within the calculator's parameters, you'll find a dedicated field labeled “Trading Fees.” When calculating your profit/loss, be sure to input your estimated or actual total fees (including commission and spread costs, if estimable). This brings your result closer to your “true net profit/loss.”

3-2: Swap / Overnight Fees

If you're a swing or long-term trader holding positions overnight, swap fees are a cost (or occasionally income) you absolutely cannot ignore.

What is it? In forex trading, when you hold a position overnight (typically past 5 PM New York time), you are effectively borrowing one currency while buying another. The differing interest rates of these currencies create the overnight interest. If your position involves a high-interest currency against a low-interest one, you may receive interest; conversely, you'll pay interest. In the vast majority of cases, retail traders will incur overnight interest costs, regardless of whether they are long or short.

Why does it matter? I once held a long position in AUD/JPY. At the time, I believed the Australian dollar would strengthen based on both technical and fundamental analysis. I maintained this long position for two months. Although the price did eventually rise, giving me a solid “paper profit,” I was shocked to discover that the overnight interest I paid over those two months had eaten away nearly 20% of my gross profit! This happened because the interest rate differential between the AUD and JPY wasn't large enough to cover the fees charged by my broker. This lesson taught me that overnight interest must be factored into any trade planned to last longer than a few days.

Calculating overnight interest is quite complex, as it depends on the currency pair, your broker, and global central bank interest rate policies. To help you tackle this challenge, we've developed a dedicated Swap Calculator. Before entering any trade that might require holding overnight, I strongly recommend using it to estimate the daily costs you may incur (or receive).

3-3: Slippage: That Invisible Variable

Slippage ranks among the most frustrating and unpredictable costs in trading.

What is it? Slippage refers to the difference between the price you see when clicking to place an order and the price at which your order ultimately executes. When you click “Buy” or “Sell,” your order must travel through the network to your broker's server before execution. During this brief interval, the market price may have changed.

Negative Slippage: The execution price is worse than expected (higher buy price, lower sell price). This is the most common scenario.

Positive Slippage: The execution price is better than expected (lower buy price, higher sell price). While possible, it's relatively rare.

During periods of high market volatility, such as the release of Nonfarm Payroll (NFP) data or central bank interest rate decisions, slippage can be significant.

How to manage it? Slippage cannot be precisely calculated before a trade. However, you can assess its impact after the trade by comparing your order details with the actual execution price. In your trading journal, dedicate a column specifically for “slippage,” noting whether it was positive or negative and the exact monetary impact. Over time, this will help you assess your broker's execution quality and the hidden costs of trading under specific market conditions. In our “True Net P&L” formula, slippage is a direct factor that adds to or subtracts from your final result.

4: How to Calculate Profit and Loss for Different Financial Instruments

Once we understand the components of cost, we can apply our “true net profit/loss” framework to various financial instruments. While the underlying principles are similar, the calculation details for forex and options differ significantly.

4-1: For Forex Trading: Understanding Pips and Lots

The core of forex trading lies in understanding the concepts of “pips” and “lots.”

Pip: The smallest unit of price movement for a currency pair. For most USD-based pairs like EUR/USD or GBP/USD, 1 pip equals 0.0001. For JPY pairs like USD/JPY, 1 pip equals 0.01.

Lot: The unit of trade quantity. A Standard Lot represents 100,000 units of the base currency. Other sizes include Mini Lots (0.1 lots) and Micro Lots (0.01 lots).

Calculating Pip Value is crucial, as it reveals how much profit or loss your account incurs per pip movement. Pip value is not fixed; it varies based on your lot size and the current exchange rate.

Manually calculating pip value is cumbersome, so I strongly recommend using our website's Pip Value Calculator before trading. Simply input your currency pair, lot size, and account currency to instantly determine the pip value.

Practical Example: Suppose you decide to go long 0.5 lots (mini 5 lots) of EUR/USD at 1.08500 and close the position at 1.09200. Your account is denominated in USD.

1. Calculate Basic Profit/Loss (Pips): 1.09200 - 1.08500 = 0.00700 = 70 pips.

2. Calculate Pip Value: Using our Pip Value Calculator with EUR/USD and 0.5 lots yields a pip value of approximately $5 per pip.

3. Calculate the base profit/loss (amount): 70 pips × $5/pip = $350.

4. Calculate transaction costs: Assume your broker charges a total commission of $15 (both sides).

5. Calculate the true net profit/loss: $350 (base profit/loss) - $15 (transaction costs) = $335.

See? This process is crystal clear. Now, take it a step further:

Open our website's Profit/Loss Calculator, select “Forex” under “Trading Instrument,” then enter: Entry Price 1.08500, Exit Price 1.09200, Position Size 0.5 lots, Trading Cost 15. Click “Calculate,” and it will instantly show your net profit of $335. Isn't that much faster than manual calculation?

4-2: For Options Trading: Calculating Contract Profit

The profit/loss calculation model for options trading differs entirely from forex, exhibiting non-linear characteristics—which is both its allure and risk. For beginners, let's start with the most fundamental concept: buying call/put options.

Core Concepts:

Premium: The cost you pay to purchase the option contract. This represents your maximum risk in the trade—you can only lose the entire premium.

Strike Price: The price at which you have the right to buy (call option) or sell (put option) the underlying asset at a future point in time.

Break-Even Point: The price level the underlying asset must reach for you to start making a profit.

>>>For a call option: Break-Even Point = Strike Price + Premium

>>>For a put option: Break-Even Point = Strike Price - Premium

Practical Example: Suppose you believe Apple Inc. (AAPL) stock will rise, currently trading at $170. You decide to buy a call option expiring next month with a strike price of $175. The premium for this option contract is $5 per share. Since one U.S. stock option contract typically represents 100 shares, your total cost is $5/share × 100 shares = $500.

Your Maximum Loss: No matter how much the stock price falls—even to zero—your maximum loss is the $500 premium paid.

Your Break-Even Point: $175 (strike price) + $5 (premium) = $180. You only start making a profit if AAPL's stock price exceeds $180 at expiration.

Scenario Analysis:

Scenario A: At expiration, AAPL stock price is $190.

Your gross profit = ($190 - $175) × 100 = $1,500.

Your net profit = $1,500 - $500 (premium cost) = $1,000.

Scenario B: At expiration, AAPL stock price is $178.

Your gross profit = ($178 - $175) × 100 = $300.

Your net profit = $300 - $500 (premium cost) = -$200. (Although the price is above the strike price, you still incur a loss.)

Scenario C: At expiration, AAPL stock price is below $175.

Your option becomes worthless, and you lose the entire $500 premium.

Analyzing option profit/loss scenarios can be complex. You can use our universal Profit/Loss Calculator to assist you. Treat the “Opening Price” as your total cost (e.g., $500) and the “Closing Price” as your final return (e.g., $1,500 in Scenario A). The calculator will quickly determine your net profit or loss. For more complex option strategies, a professional option calculator is more helpful, but our tool suffices for understanding basic profit/loss scenarios.

5: The Game-Changer: Factoring in Leverage and Risk

So far, we've discussed absolute profit/loss amounts. However, in trading—especially leveraged trading—the percentage of profit/loss, particularly relative to your account equity, is the true measure of a trade's impact. Leverage is the “game-changer” that dramatically magnifies or minimizes this percentage.

5-1: How Leverage Magnifies Your Percentage Gains and Losses Like a Magnifying Glass

Leverage allows you to control a much larger trade with a smaller amount of your own capital (margin). For example, 100:1 leverage means you only need $1,000 in margin to control a $100,000 trade.

Leverage is an incredibly sharp double-edged sword. It can make your profits look incredibly tempting, but it can also make your losses excruciatingly painful.

Comparative Scenarios: Suppose you have a $5,000 trading account. You decide to trade using $1,000 as margin.

Scenario A: Trading Without Leverage

You buy stocks with $1,000.

The stock price rises by 10%, increasing your position's value to $1,100, yielding a $100 profit.

This $100 profit represents a 2% return relative to your total account value ($5,000).

Scenario B: Forex Trading with 100:1 Leverage

You use $1,000 as margin to open a $100,000 position (1 standard lot).

The market moves just 1% in your favor.

Your profit is $100,000 × 1% = $1,000.

This $1,000 profit represents a 20% return relative to your total account balance ($5,000)!

See the staggering difference? Leverage transforms a 1% market fluctuation into a 20% gain for your account. But consider the flip side: what if the market moves 1% against you? You would also lose $1,000, instantly wiping out 20% of your account. If the market moves more sharply, say 5%, your account would be liquidated and wiped out entirely.

Leverage is closely tied to margin. Before opening a position, understanding how much margin this trade requires and how much price movement you can withstand is a matter of life and death. I strongly recommend using our Margin Calculator. It will tell you how much margin is required based on your leverage level, trading instrument, and lot size, as well as how much available margin you have left.

5-2: How to Calculate Stop Loss and Take Profit for Strategic Trading

If leverage is the accelerator of a car, then Stop Loss is your brake. In any leveraged trade, an accelerator without brakes is suicide.

Setting stop-loss and take-profit levels is both an art and a science. At its core lies the risk/reward ratio. This is the question every professional trader must ask before pulling the trigger: “How much risk am I willing to take for the potential reward?”

A healthy risk/reward ratio is typically recommended at 1:2 or higher. This means you're willing to risk losing $1 to potentially gain $2 or more.

Calculation Method:

1. Determine your risk amount: For example, you decide to risk no more than 2% of your account balance per trade. If your account is $5,000, your maximum risk amount is $100.

2. Determine your stop-loss point: Using technical analysis (e.g., placing it below a key support level), calculate the price point where your loss would be exactly $100.

3. Calculate your position size: Knowing the stop-loss distance (e.g., 50 pips) and risk amount ($100), you can determine the appropriate position size.

4. Set your take-profit target: Based on your risk-reward ratio, if your stop-loss distance is 50 pips and your risk-reward ratio is 1:3, your take-profit target should be set at a profit of 150 pips.

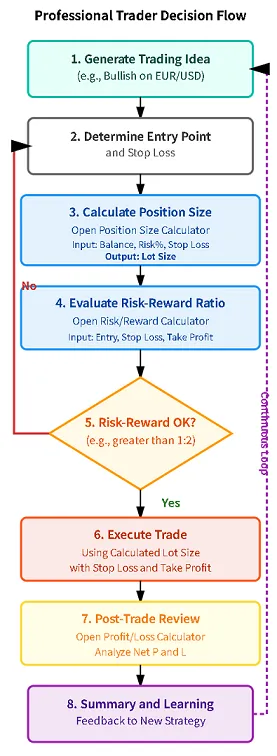

This pre-trade planning process is crucial, but manual calculations are mentally taxing. This is where our website's other two “crown jewels” come into play:

Risk/Reward Calculator: Visualize your trade and set stop-loss and take-profit targets.

Position Size Calculator: Automatically determines the optimal lot size based on your risk amount and stop-loss level.

Professional Trader's Entry Process:

This process transforms trading from gut-feeling gambling into a planned, disciplined, and risk-controlled professional operation.

6: From Calculation to Management: Building Your Personal Trading Journal

So far, we've learned how to calculate the profit/loss of a single trade precisely. But true growth comes from connecting these isolated data points into a cohesive narrative—a complete picture of your trading performance. This narrative is captured in your Trading Journal.

6-1: Why Your Trading Journal Is Your Most Powerful Secret Weapon

If your calculator is your weapon, then your trading journal is your command center. In my view, a trader without a journal is like an athlete who never reviews game footage—unable to identify weaknesses and improve systematically.

A good trading journal helps you:

1. Objectively evaluate strategies: Under what market conditions does your strategy work? What's your average risk-reward ratio? What's your win rate? Only data can answer these questions.

2. Control trading emotions: When you document the rationale and mindset behind each trade, you uncover impulsive or revenge trading patterns. The act of recording itself instills discipline.

3. Identify recurring mistakes: You may be surprised to discover that your losses stem from the same few error patterns, repeating over and over.

4. Build Positive Feedback Loops: Watching your profit records grow steadily (even slowly) in your log provides immense confidence and motivation.

6-2: How to Use Our Calculator to Build Your Trading Log (Workflow)

You don't need complex software—a simple Excel spreadsheet or Google Sheet suffices. The key lies in what you track. Here's a minimal yet effective template I recommend:

| Date | Instrument | Direction | Entry Price | Exit Price | Position Size | Trading Fees | Overnight Interest | Actual Net P&L | Risk-Reward Ratio | Reason / Notes |

|---|---|---|---|---|---|---|---|---|---|---|

| 10/07 | EUR/USD | Long | 1.0850 | 1.0920 | 0.5 lots | $15 | $0 | $335 | 1:3 | Broke the key resistance level |

| 10/08 | AAPL Opt | Call | $500 | $300 | 1 contract | $2 | $0 | –$202 | N/A | Earnings missed expectations… |

| … | … | … | … | … | … | … | … | … | … | … |

Your workflow should be as follows:

1. After completing a trade, don't immediately start the next one. Give yourself a few minutes.

2. Open our website's Profit/Loss Calculator.

3. Enter all actual data for this trade: the real entry price, exit price (which may differ slightly due to slippage and your plan), position size, total fees paid, and total overnight interest accrued during the holding period.

4. Click “Calculate” to get that one, most important number—your “True Net P&L.”

5. Meticulously enter this figure, along with all other details, into your trading journal spreadsheet.

Stick with this for a month, then revisit the spreadsheet. Your understanding of your own trading will undergo a quantum leap. For the first time, you'll truly “see” your trades.

7: Using Our Profit/Loss Calculator: A Best Practices Guide

To help you get the most out of this essential tool, I’d like to share a few best practices I’ve identified:

The “garbage in, garbage out” principle: The calculator’s accuracy depends entirely on the accuracy of your input data. Always use your actual trade price, not your desired price. Verify this in your trade history after the transaction.

Understanding Fee Fields Correctly: The “Trading Fees” field should reflect the total cost of the trade. If your broker charges both sides, remember to add the opening and closing fees together.

Verify Position Unit: Ensure the “Position Size” unit you enter is correct. For forex, it's “lots”; for stocks, it's ‘shares’; for options, it can be “contracts.”

It serves as both a review tool and a planning tool: After trading, it helps you conduct precise reviews. Before trading, you can use it to simulate different exit scenarios and see your potential profit or loss at various exit points, helping you develop trading plans with greater confidence.

8: My Personal Perspective and Deep Insights

At this point, we've covered many technical details about “calculations.” But I'd like to take a moment to discuss the deeper meaning behind these calculations. In my view, the ultimate goal of mastering calculations is to reach a point where you “no longer need to calculate.”

What does this mean? Once you internalize this process of calculation and documentation into instinct and habit, you no longer need to obsess over “how much did this trade actually make?” Your focus shifts from the singular, emotional outcome of “profit or loss” to the broader, more rational “process.” You begin asking yourself higher-quality questions:

“Did I strictly adhere to my trading system when entering this position?”

“Did my stop-loss placement truly protect me?”

“Was the risk-reward ratio of this trade within my strategy's acceptable range?”

“Regardless of whether this trade ended in profit or loss, what did I learn that I can apply to the next trade?”

Trading, at its core, is a game of probability and discipline. Every calculation we make builds upon the pillar of “discipline.” When you have a clear understanding of your costs, an accurate measurement of risk, and a reasonable expectation of potential returns, you won't be shaken by the market's short-term, random fluctuations. Because you know that as long as you stick to executing your system with a positive expected value, one or two losses are insignificant. It's like a casino owner who doesn't care whether an individual gambler wins or loses. He only cares that the casino's rules guarantee his long-term profitability.

We retail traders must strive to become the “casino owners” of our own trading worlds. Our calculators are the tools that help us establish and validate these casino rules. So, please don't view using these calculators as a tedious chore. Instead, view it as a sacred ritual you perform daily as a professional trader. It is precisely these seemingly tedious details that ultimately separate you from the majority who trade on gut feelings and are eventually weeded out by the market.

9: Summary and Action Recommendations

Alright, friends, our deep dive is nearing its end. Let's quickly recap the significant gains you've made today:

1. You've learned to distinguish between “base profit/loss” and “true net profit/loss,” completing the critical shift from amateur to professional thinking.

2. You've mastered how to break down transaction costs, identifying profit killers like trading fees, overnight interest, and slippage.

3. You now possess a clear workflow, knowing how to leverage our website's calculator matrix (pip value, position size, risk-reward ratio, profit/loss, etc.) for systematic trade planning and review.

4. You understand the immense value of building a trading journal and have received a ready-to-use template.

Now, the knowledge is in your mind, but true change comes from action.

9-1: My actionable advice for you is:

Starting with your next trade, strictly follow the process we discussed today. Plan it, execute it, and most importantly—calculate and record it. Don't skip this step. Stick with it for 21 days until it becomes muscle memory.

9-2: Call to Action

You now possess all the theoretical knowledge to become a more professional trader. Now, let tools empower you! CLICK HERE to start exploring all our free trading calculators on our website today and elevate your trade analysis and risk management to heights you never imagined!

10: Final Risk Warning

Please allow me to remind you once more: financial trading involves significant risks. This article and our tools are intended to provide information and support, but they must never replace your own independent judgment and prudent risk management. Never invest funds you cannot afford to lose. Markets are unforgiving, but knowledge and discipline are your best armor.

11: Continue Reading: Explore More Related Knowledge

To help you build a more comprehensive knowledge base, I've selected the following highly relevant articles from our library for your continued reading:

12: Sources Cited

Investopedia. “Pip - Forex”.

Investopedia. ‘Slippage’

Investopedia. “Break-Even Point (BEP)”.

Leave a Comment: