(You can read this guide or click the link to our Position Size Calculator)

Hey, friend! Welcome to my little corner of the web. In this world of trading, full of temptations and pitfalls, I'm often asked one question: “What's the secret to success?” Is it some magical indicator? Or an infallible strategy? My answer might surprise you: In trading, what determines whether you survive or not isn't how many times you guess right, but how much you lose when you think wrong.

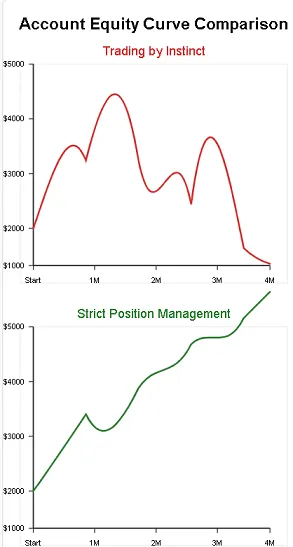

I've seen too many smart people who can accurately predict the market and catch several nice rallies, only to lose everything in one uncontrolled loss and exit the game in disappointment. Where did they go wrong? They placed orders based on “feelings.” Feeling good today, they buy more; feeling a bit scared tomorrow, they buy less. This approach is essentially no different from betting on heads or tails in a casino.

The dividing line between professional traders and amateurs lies in a seemingly simple concept: Position Sizing. It's a science—the science of determining “exactly how much I should buy this time.” It ensures you can stay at the table even after consecutive losses, waiting for the next opportunity.

This article is your ultimate guide. I'll walk you through every facet of position sizing—whether you're trading stocks, high-volatility cryptocurrencies, or leveraged futures. More importantly, I'll provide you with a tool I built from scratch, designed purely for calculation. It's simple, fast, and distraction-free, helping you integrate this science into every trading decision.

⭐ Important Risk Warning and Disclaimer

Before we dive in, I must emphasize: All investing and trading involve significant risks, and you could lose your entire principal. This article and all tools provided on this site are intended solely for educational and informational purposes and do not constitute any form of investment or financial advice. Markets are unpredictable, and past performance does not guarantee future results. Before making any trading decisions, conduct thorough independent research and consult a licensed financial advisor when necessary. Only risk capital you can afford to lose.

1: The Philosophy of Trading: Why Position Sizing Matters More Than Your Trading Strategy

You might find it odd that I prioritize position sizing over trading strategy. Sounds counterintuitive, right? After all, don't we enter the market to find that strategy that “makes money”? Allow me to share a personal experience that might change your perspective.

1-1: From Amateur Gambler to Professional Trader: A Mindset Shift Forged by a Painful Lesson

I remember it was 2017, during the frenzy of the first major cryptocurrency bull market. As a novice, I thought I'd discovered a “wealth formula”—a certain altcoin with seemingly flawless technical patterns and a community buzzing with bullish sentiment. I was fired up, convinced I'd tapped into the pulse of the times. I poured nearly half my account balance into that single coin in one all-in bet. I hadn't even seriously considered where to set my stop-loss if I was wrong.

The result? Within 48 hours, a single piece of negative news sent market sentiment plummeting, and the coin's price halved overnight. I watched my account equity plummet like a cliff, completely stunned. It wasn't just about losing money—it was the collapse of my convictions and a profound sense of helplessness. Paralyzed by fear, I refused to close my position, clinging to the hope it would rebound. Instead, it kept falling until my account losses exceeded 60%. Only then, in excruciating agony, did I finally “cut my losses.” That single trade nearly wiped me out of the market.

For months afterward, I didn't place a single trade. I spent countless hours reviewing my mistakes, studying, and reading biographies of successful traders. I discovered a startling commonality: they rarely discussed their “magical” predictive abilities, but repeatedly emphasized risk management and capital preservation. In that moment, it dawned on me—my previous actions weren't “trading” at all, but gambling. I was betting on the outcome of a single trade, while they operated a probabilistic system designed to weather bull and bear markets, enduring countless wins and losses. From that day forward, my trading philosophy transformed completely. I evolved from a gambler seeking the “Holy Grail” into a risk-managing “businessperson.” The core of this transformation began with precisely calculating the size of every position.

1-2: The Three Pillars of Survival: Capital Preservation, Risk Consistency, and Emotional Control

Once you adopt scientific position sizing, your trading instantly rests upon three rock-solid pillars, delivering unprecedented stability.

The first pillar, and most crucial, is capital preservation. Imagine your trading account as your health bar on the battlefield. No matter how powerful your attacks (strategies), once your health hits zero, the game is over. The core task of position sizing is to ensure that the health you risk in a single battle (trade) is always a tiny, controllable percentage (say, 1%) of your total health. This way, even if you take five or ten consecutive hits from the enemy, you'll only suffer minor injuries. You'll retain enough strength to keep fighting, waiting for that one opportunity to land the decisive blow. Without this foundation, even the best strategy is nothing but a castle in the air.

The second pillar: Consistent Risk. Suppose you have a $10,000 account and decide to risk only 1% per trade—$100. When trading low-volatility blue-chips like Coca-Cola, your stop-loss might only need a 2% distance. The calculator would tell you to buy $5,000 worth of stock. But when trading highly volatile cryptocurrencies (like Dogecoin), you might need a 30% stop-loss buffer, and the calculator would tell you to buy only about $333 worth of coins. See, even though the asset values you're buying differ vastly, the maximum loss risk you bear for both trades is exactly the same—$100. This eliminates the problem of risk fluctuating wildly due to differing asset volatilities, making your entire trading system exceptionally stable and quantifiable.

The third pillar: Emotional Control. This is the inevitable outcome of the first two pillars and the crucial psychological factor for trading success. When you clearly know before every order, “For this trade, I will lose no more than XX dollars,” you gain immense inner peace. You won't panic over normal price corrections, nor will you prematurely close a potentially profitable position out of fear of loss. Because risk is defined and acceptable, you can channel all your energy into executing your trading plan. Precise position sizing is arguably the most effective cure for “trading phobia” and “greed syndrome.”

2: Unveiling the Math: How Our Position Sizing Calculator Works

Having covered the philosophical importance, let's examine the technical side. The mathematical principle behind position sizing is actually quite simple—perhaps even a bit dry. Yet this straightforward formula forms the cornerstone of professional risk management.

2-1: A Deep Dive into the Universal Formula

No matter how flashy the interface, every position sizing calculator boils down to this core formula:

Position Size (Lots) = (Total Account Size × Risk Percentage) / (Entry Price - Stop Loss Price)

Let's break down this formula and explain each part in plain language:

Account Size: This is straightforward—your total trading capital. For example, $10,000.

Risk Percentage: This is your subjective decision—the maximum loss you're willing to risk as a percentage of your total capital for this trade. I typically recommend beginners start with 0.5% or 1%, while experienced traders might use up to 2%. Let's use the 1% example mentioned earlier.

Risk Capital: This is the product of the two above: $10,000 × 1% = $100. This $100 is your “risk budget” for this trade—the “entry fee” you're willing to pay for this opportunity. Regardless of how many shares or coins you ultimately buy, if the trade hits your stop-loss, your maximum loss will be precisely controlled around $100 (excluding slippage and other factors).

(Entry Price - Stop-Loss Price): This represents the “safety margin” you set for the trade, or the potential risk per share/coin. For example, if you plan to buy a stock at $150 and set a stop-loss at $145, the potential risk per share is $150 - $145 = $5.

Now, plug all the numbers into the formula:

Position Size (Shares) = $100 / $5 = 20 shares

There you have it. To ensure your maximum loss on this trade doesn't exceed $100, you should buy 20 shares. It's that simple, yet incredibly powerful. This formula ensures your risk budget is evenly distributed across the risk per share/coin you're willing to take.

2-2: Why Manual Calculations Are Both Dangerous and Slow

If the formula is so simple, why do we need a calculator? Good question! Here are three reasons:

1. Speed is Paramount: In trading, opportunities are fleeting. When you spot a perfect entry point, you might have only seconds to react. If you have to open a calculator app and manually type 10000 * 0.01 / (150 - 145), the best price could vanish before you finish. A good online calculator lets you input a few parameters and instantly displays the result.

2. Avoiding Human Error: People are prone to mistakes when stressed or excited. A misplaced decimal point or an extra zero can lead to disastrous consequences. You intended to buy 20 shares but calculated 200 instead, instantly multiplying your risk tenfold. This is a basic error that is entirely preventable and must be avoided.

3. Handling Complexity: For stocks, the formula above is relatively simple. But when trading forex (involving pip values), futures (involving contract sizes and point values), or cryptocurrency pairs requiring conversions, manual calculations become exceptionally complex and tedious. A good calculator has this logic built-in—you only need to input the most basic price information, and it handles all the complex intermediate steps for you.

My website was created precisely to solve these problems. I wanted a pure tool—open the page, enter numbers, get results—with no ads, pop-ups, or complicated login processes to distract me. I believe you do too.

3: Practical Application: Master Classes Tailored for Different Asset Classes

The core principles of risk management are universal, but when applied to different markets, we must pay attention to certain nuances. Next, I'll guide you through conquering the three major markets—stocks, cryptocurrencies, and futures—one by one, empowering you to become a risk management master capable of navigating across markets.

3-1: For the Stock Market: Calculating How Many Shares to Buy (Shares)

Stock trading is where most people begin their journey, and its position sizing is the most straightforward. The core task is determining how many “shares” you should purchase.

Unique Challenges:

The stock market presents relatively simple challenges, primarily managing fractional prices and ensuring you understand transaction commission costs. Our calculator focuses on core risk calculations, but in practice, you must factor commissions into your total risk exposure. For beginners, however, getting the core position size right already constitutes 90% of success.

Step-by-Step Practical Exercise:

Scenario: Assume your account holds $25,000. You've been monitoring Tesla (TSLA), which recently rebounded from a key support level—presenting what you view as a favorable buying opportunity.

Trading Plan:

Current Price / Entry Price: $180

Stop Loss Price: You decide to place your stop loss below the support level at $175.

Risk Preference (Risk %): As a conservative trader, you decide to risk only 1% of your account balance.

Calculation Process:

Calculate Risk Capital: $25,000 * 1% = $250. This is the maximum “tuition fee” you're willing to pay for this trade.

Calculate Risk Per Share: $180 - $175 = $5.

Calculate Number of Shares to Buy: $250 / $5 = 50 shares.

Decision: You should buy 50 shares of Tesla stock. If the stock price unfortunately drops to $175 and triggers your stop-loss, your loss would be approximately 50 shares * $5/share = $250, exactly matching your pre-set risk limit.

Now, don't just watch me calculate. Open our calculator, enter these numbers yourself, and feel the power this certainty brings you.

3-2: For Cryptocurrencies: Navigating Extreme Market Volatility

The cryptocurrency market is renowned for its staggering volatility—an opportunity and a massive risk. Entering this space without position management is like driving blindfolded on a highway.

Unique Challenges:

Cryptocurrencies trade 24/7 with extreme price swings, often seeing 10% or even 20% intraday volatility. This means your stop-loss levels typically need to be set wider, or you risk getting “washed out” by market noise. And the wider your stop-loss, the smaller your position size must be within a fixed risk capital. This is precisely why position sizing is critical in crypto markets—it forces humility and caution.

Hands-On Practice:

Scenario: Your crypto trading account holds $8,000 USDT. You observe Ethereum (ETH) testing a key weekly support level and plan to enter a long position.

Trading Plan:Entry Price: $3,500

Stop Loss Price: Considering volatility, you place your stop well below the support zone at $3,200.

Risk %: Given the high-risk market, you opt for a conservative 0.8% risk allocation.

Calculation Process:

1. Calculate Risk Capital: $8,000 * 0.8% = $64.

2. Calculate Risk per Coin: $3,500 - $3,200 = $300.

3. Calculate Quantity to Buy: $64 / $300 = 0.2133 ETH.

Decision: You should buy approximately 0.2133 ETH. Seeing this number might surprise you—“So little?” Yes, precisely because Ethereum has significant potential downside, you can only hold such a small position to cap your maximum loss at $64. This exemplifies discipline. Those who get wiped out in crypto markets often buy 1 ETH or more based on gut feeling in such situations.

Don't gamble based on gut feelings. Use math to protect your capital.

3-3: For Futures Markets: Easily Manage Leverage and Contract Specifications

Futures trading can seem intimidating to beginners due to leverage and standardized contracts. What is “contract size”? What is “tick value”? Don't worry—a good calculator shields you from these complexities.

Unique Challenges:

Leverage is at the core of futures, amplifying both profits and losses. Thus, position management is more critical in futures than any other market. Additionally, different futures contracts (like crude oil, gold, or stock index futures) have vastly different specifications, making manual calculations prone to errors.

Our Calculator's Advantage:

My design philosophy is that you don't need to be a futures expert to manage risk effectively. You only need to focus on two core elements: your entry price and stop-loss price (in USD), and the amount of risk you're willing to take. Our calculator automatically handles the underlying logic for you. (Note: This requires your calculator design to allow direct price input or offer preset modes for common futures contracts to simplify calculations.)

Step-by-Step Practical Exercise:

Scenario:

Your futures account holds $50,000. You're trading E-mini S&P 500 Index Futures (ticker ES) and anticipate the market will rise.

Trade Plan:

Entry Price: 5000.00 points

Stop Loss Price: 4990.00 points (10-point decline)

Risk Preference (Risk %): You decide to risk 0.5% of your account balance, a conservative and common ratio in futures trading.

Key Information Needed Before Calculation:

For ES contracts, each point is worth $50. (This is basic futures trading knowledge; your article should briefly explain it.)

Calculation Process:

Calculate Risked Capital: $50,000 * 0.5% = $250.

Calculate risk per contract: (5000.00 - 4990.00) pips * $50/pip = 10 pips * $50/pip = $500. This means trading one ES contract with a stop-loss 10 pips away exposes you to a potential loss of $500.

Calculate number of contracts to trade: Risk Capital / Risk per Contract = $250 / $500 = 0.5.

Decision:

The calculation yields 0.5 contracts. However, since standard ES contracts cannot be traded in half-lots, you face a choice: either abandon this trade because its minimum risk requirement ($500) exceeds your risk budget ($250); or trade the smaller Micro E-mini contract (MES), where each point is worth $5, reducing single-contract risk to $50. You could then trade $250 / $50 = 5 MES contracts. See how position sizing even helps you choose the right trading product!

4: Advanced Considerations: Solving Your Toughest Questions

Once you master the basics, deeper questions may arise. Don't worry—I've encountered these myself and found answers for you.

4-1: What Risk Percentage Should I Use? (Beginner, Intermediate, and Pro Trader Guide)

There's no one-size-fits-all answer, as it hinges on your risk tolerance, strategy win rate, and risk-reward ratio. But here's a practical framework:

| Trader Level | Recommended Per-Trade Risk Percentage | Core Reasoning |

|---|---|---|

| Beginner (0–1 years) | 0.5 % – 1 % | Your primary goal is to “survive” and learn. At this stage, controlling losses is far more important than generating profits. Low risk minimizes the cost of making mistakes. |

| Intermediate (1–3 years) | 1 % – 2 % | You have a proven trading system and a relatively stable mindset. You can moderately increase risk to pursue more substantial returns. |

| Professional Trader (3+ years) | Typically remains 1 % – 2 % | True professionals understand the reality of “black swan” events. They pursue long-term, repeatable success rather than chasing one-off windfalls. They diversify risk through multiple strategies and asset classes, avoiding heavy bets on single trades. |

My personal recommendation:

Regardless of your stage, I strongly advise starting at **1%**. This is the gold standard, striking the perfect balance between risk control and potential reward. Maintain this ratio for at least 3-6 months to complete a full trading cycle before fine-tuning based on your actual performance and psychological comfort. Remember, consistency trumps everything.

4-1: The “Correlation Trap”: Managing Your Portfolio's Overall Risk

This is a common pitfall for beginners. Suppose you spot three excellent trading opportunities simultaneously: going long on Nvidia (chip stock), going long on AMD (chip stock), and going long on ASML (lithography giant). Their technical patterns look perfect, so you allocate 1% risk to each trade.

On the surface, you're disciplined. But what's the reality? All three companies operate in the highly correlated semiconductor industry. If negative news hits the entire sector—say, new U.S. export controls—they'll likely fall together. Suddenly, all three trades could trigger stop-losses simultaneously, wiping out 3% of your account instantly! Your actual risk exposure tripled without your awareness.

How to avoid it?

1. Recognize correlations: When holding multiple trades, ask yourself: "What drives these assets? Do they rise and fall together?"

2. Group and Manage Risk: Treat highly correlated trades as a “trading portfolio” and set an overall risk cap for this group. For example, you could stipulate: “My total exposure to the semiconductor sector must not exceed 1.5%.” This allows you to allocate that 1.5% risk across Nvidia, AMD, and ASML—say, 0.5% each.

3. Utilizing Tools: Tools exist to analyze historical correlation coefficients between assets, but these may be overly complex for beginners. The simplest approach is to rely on common sense and maintain diversification across trading instruments.

4-2: My Account is Small—Is That a Problem? Survival Rules for Small Accounts

“My account is only $500. Risking 1% per trade means just $5—the calculated position size is pitifully small. It feels impossible to make money. What should I do?” I've received this question countless times.

Friend, let me be honest: if you think this way, you haven't truly grasped the essence of trading. Trading isn't a “get-rich-quick” game—it's a “slow-wealth-building” business. For small accounts, position management is even more critical because your margin for error is slimmer.

Survival Rules for Small Accounts:

1. Shift your mindset: Don't set goals around “earning X amount of money.” Instead, focus on “executing my trading system X number of times without blowing up my account.” Your primary objective is to accumulate experience and refine your strategy, not to profit.

2. Prioritize percentage returns: Don't fixate on a $5 profit. Look at it as a percentage of your account balance. If your $500 account grows to $550 after a few trades, congratulations—you've achieved a 10% return! This is a remarkable accomplishment. Even Wall Street's top fund managers pursue annualized returns of only 20%-30%.

3. Leverage Micro Contracts/Fractional Shares: Brokerage services have significantly improved. Futures offer micro contracts, and stocks allow fractional share trading. These tools enable precise position management for small accounts.

4. Patience is the greatest virtue: Turning $500 into $1000 ($500 profit) over a year through strict risk management holds far greater significance and difficulty than luckily doubling $500 to $2000 only to lose it all. The former proves your skill; the latter proves only your luck. Ultimately, the market rewards only those with genuine ability.

5: Our Advantage: Why a Simple, Focused Tool Is Your Best Ally

You may find that many powerful trading platforms on the market integrate real-time charts, news, social features, and complex calculation functions. In comparison, my website and tools might seem a bit “bare-bones.” Yes, that's intentional.

5-1: The Power of Less is More: No Ads, No Distractions—Pure Calculation

In my view, the scarcest resource in trading is focus. At the critical moment of making buy/sell decisions, any pop-up ad or irrelevant news alert can disrupt your mindset, leading to emotional choices.

Therefore, I deliberately designed my website tools with extreme purity:

No ads: I don't want you distracted by “get-rich-quick” ads while calculating risks.

No social features: I don't want you influenced by others' opinions. Trading is a dialogue between you and the market—free from noise.

No real-time data feeds: Why? Because the most accurate prices and rates always come from your own trading platform. Third-party data inevitably suffers from delays or discrepancies. My tools only require you to input prices you see with your own eyes, ensuring calculations align precisely with your actual execution environment.

Lightning-fast loading: This page contains only core code, guaranteeing sub-second loading on any device—never miss an opportunity.

What I offer isn't entertainment, but a precision-engineered, reliable professional tool like a Swiss Army knife. Its “simplicity” empowers your “expertise.”

5-2: Common Pitfalls to Avoid When Using Any Calculator

Even with the best tools, we must understand their limitations and pay attention to practical details:

1. Slippage: When placing an order, the final execution price may slightly differ from your anticipated price, especially during rapid market fluctuations. This means your actual stop-loss loss could be marginally higher than calculated. This is a normal cost of trading, and you should be mentally prepared for it.

2. Commissions & Fees: Most trading platforms charge commissions or spread fees. Theoretically, these should be factored into your total risk calculation. Beginners may initially ignore them, but as you advance, always include transaction costs in your risk assessment.

3. Swaps: If you hold positions overnight, especially in forex and CFD trading, overnight interest accrues, which also impacts your final profit or loss.

4. “Set It and Forget It”: The purpose of a stop-loss is that once set, you should never arbitrarily adjust it (especially in the direction of increasing losses). The calculator establishes your risk floor; your task is to execute it resolutely.

6: Your Ultimate Pre-Trade Toolkit

To professionalize and systematize your trading process, I recommend making the following steps an unbreakable ritual before every order placement.

Step 1: Determine Your Position Size Using Our Calculator

This is the cornerstone of all steps. Never click that “Buy” button until you know exactly how much to buy.

Step 2: Use the Risk-Reward Ratio Calculator to Check the Trade's “Value”

After determining your position size, ask yourself: “Is this trade worth taking?” In other words, is your potential profit at least 1.5 to 2 times your potential loss? If not, it might not be a good trading opportunity.

Step 3: Download Your Free Pre-Trade Checklist (PDF)

To help you build good habits, I've created a sleek “Pre-Trade Checklist” just for you. Print it out and keep it on your desk. Before every trade, go through each item to ensure you haven't missed any critical steps.

finwizcalc.com_Pre-Trade_Checklist.pdf.pdf Click the PDF link to download the Professional Trader Pre-Trade Checklist for Free.

7: Frequently Asked Questions (FAQ)

Q1: Is this position sizing calculator free?

A: Yes, completely free. My original purpose for creating this website was to share knowledge and tools to help independent traders like myself. It will always remain free in the future.

Q2: Can I use this calculator for forex trading?

A: Great question! For forex trading, the calculation logic differs slightly due to “pips” and varying pip values across currency pairs. For this purpose, I've created a dedicated “Pip Value Calculator.”

Q3: Does leverage affect my position sizing calculations?

A: This is an excellent advanced question! The answer is: leverage does not impact your risk-based position sizing calculations, but it determines whether you have the “capacity” to open the calculated position. Your position size should only be determined by your account size and risk percentage. Leverage is merely a tool allowing you to control a larger position with less margin. Remember, high leverage is a double-edged sword—it doesn't increase your profit margin but amplifies your profit/loss volatility. Always prioritize risk over the maximum leverage you can use.

Q4: What if my broker won't allow the position size calculated by the tool?

A: This is a practical concern, especially when trading high-priced stocks or contracts with a small account. You have two options:

1) Seek a better trading opportunity where the stop-loss can be set closer, resulting in a larger calculated position.

2) If none is found, decisively abandon the trade. This is part of risk management—identifying and walking away from trades that don't align with your risk model. Discipline, sometimes, lies in what you choose not to do.

8: Conclusion: Take Control of Your Trading Destiny

Friend, we've covered a lot today—from trading philosophy to mathematical formulas, and practical applications across markets. If you've made it this far, I'm genuinely thrilled for you, because you've already surpassed 90% of traders.

Remember, markets are inherently uncertain. We cannot control price movements. However, what we can control 100% is the risk we take on every single trade. Position sizing is the “remote control” in your hands that manages that risk.

It won't make you rich overnight, but it ensures you won't blow up your account overnight. It doesn't guarantee your next trade will be profitable, but it guarantees you'll always have the capital and endurance to keep running in this marathon called trading.

Starting today, bookmark our calculator in your browser. Make it your mandatory “security checkpoint” before every trade. Master your risk, and profits will follow. Welcome to the world of professional trading.

My Personal Perspective and Final Warning

In my view, trading success ultimately boils down to self-awareness and self-management. The market acts like a mirror, ruthlessly reflecting every flaw in your humanity: greed, fear, complacency, impatience. Position sizing management is the code of conduct you establish for yourself—a mandatory discipline. When you're most impulsive or fearful, it pulls you back with cold mathematical logic, reminding you: “Hey, calm down. We have rules.”

I've witnessed countless “chart masters” who master technical analysis to perfection yet end up losing everything—because they couldn't overcome emotional swings and abandoned discipline at critical moments. Conversely, I've seen traders with remarkably simple, even “clumsy” strategies consistently turn a profit because they've ingrained risk management into their very bones, executing it with unwavering consistency for decades. So stop obsessing over finding that “holy grail” that predicts the future. The true “holy grail” lies in your reverence for and management of every single risk.

Final Risk Warning:

This article provides you with a framework and tools for risk management, but it does not guarantee your profitability. Trading is a game of probabilities. Even if you get everything right, you may still face consecutive losses. This “account drawdown” is a normal part of trading. Ensure you are fully mentally prepared for this reality. Never trade with borrowed money or funds that compromise your quality of life. In the vast ocean of financial markets, maintain the utmost reverence for risk at all times.

Good luck.

References:

Dalbar's 2023 Quantitative Analysis of Investor Behavior, a study often cited for showing how emotional decisions lead to investors underperforming the market.

Investopedia, “Position Sizing”. An excellent primer on the basics of the concept.

CME Group, “E-mini S&P 500 Futures Contract Specs”. Official source for futures contract information.

Leave a Comment: