(You can click here to our Compound Interest Calculator page or read this guide)

1: The Ultimate Guide: Use a Compound Interest Calculator to Map Out Your Financial Goals

Hey, friend. Have you ever sat up late at night, imagining what your future might look like? Maybe it's buying that dream home, giving your family a haven; maybe it's telling your boss in your early 40s, "The world is so big, I want to go see it," achieving financial independence and retiring early (FIRE); Or maybe, like me, you're a forex trader dreaming of watching that small trading account grow into a substantial fortune over time.

These dreams are beautiful and thrilling. But soon, a practical question pulls us back down to earth: "Then what? How do I get there?"

Most of us have only a vague goal—like wanting to reach a distant city without a map. We don't know where to start, how far to go each day, or what obstacles lie ahead. This uncertainty is often the number one killer of dreams.

Today, I'm sharing that "map" with you. I'll show you how to use an incredibly simple yet powerful tool—the compound interest calculator—to transform your vague dreams into a clear, quantifiable, actionable numerical plan.

I created this website and these calculators because I grew tired of financial tools cluttered with ads, complex designs, and distractions. I wanted a pure, fast, core-function-focused companion. So I built it—for myself and for explorers like you.

This isn't a dry manual. It's the distilled wisdom of my years, the guide I wish I'd had when I started. I'll take you deep into:

How to plan for long-term goals like "saving for a house."

How to strategically plan for ultimate dreams like "Financial Independence, Retire Early (FIRE)".

Plus, a unique perspective rarely discussed: how forex traders can leverage this tool to build a hybrid growth model combining "trading profits + fixed savings".

Ready? Let's take those dreams from the clouds and step by step, bring them down to earth.

2: The "Magic" of Compound Interest: Understanding the Core Engine of Wealth Growth

Before diving into the calculator, we must take a few minutes to truly grasp the underlying logic driving it all—compound interest. Einstein called it "the eighth wonder of the world," and that's no exaggeration. But I'd like to explain it with a more relatable analogy: rolling a snowball.

Imagine a long, snow-covered hillside. You scoop up a small handful of snow with your hands—this is your principal. You place it on the ground and start rolling it down the slope. The snowball picks up more snow, growing slightly larger. This is the interest earned in the first year. Traditional "simple interest" thinking is like scooping up a fresh, identical-sized ball of snow each year and starting over. "Compound interest" thinking, however, lets that already-enlarged snowball keep rolling down the slope.

Something magical happens: a larger snowball picks up more snow over the same distance. In other words, your interest itself starts "working" for you, earning you new interest. This is "interest on interest."

I remember dismissing this concept when I first started trading. I thought compounding was too slow. I was chasing a big "home run"—one massive move that would double my account. The outcome was predictable: I suffered frequent losses chasing high risks, my account fluctuating wildly like an electrocardiogram. Yet by year-end, it was nearly unchanged. That changed when I casually simulated a compound interest calculator: What if I started with a $5,000 account, eschewing doubling for a "boring" yet sustainable 2% monthly gain? What would it look like after 10 years?

When that number popped up, I was stunned. That seemingly insignificant 2% had, over time, ballooned into a staggering figure. In that moment, I truly grasped: in the world of investing and trading, time is the most powerful lever, and compound interest is the fulcrum that maximizes that leverage.

Is it slow? Yes, in the beginning, it crawls like a snail. In the first year, you might see only a tiny, insignificant bump—enough to make 90% of impatient people quit. But if you persevere past that "tipping point," growth accelerates. It shifts from linear to exponential, the growth curve steepens dramatically, and eventually, it becomes an avalanche of wealth.

The table below illustrates this concept more vividly. Suppose we start with $10,000 principal and a 10% annualized return:

| Year | Simple Interest Account Total | Compound Interest Account Total | Amount Compound Interest Exceeds Simple Interest |

|---|---|---|---|

| 1 | $11,000 | $11,000 | $0 |

| 5 | $15,000 | $16,105 | $1,105 |

| 10 | $20,000 | $25,937 | $5,937 |

| 20 | $30,000 | $67,275 | $37,275 |

| 30 | $40,000 | $174,494 | $134,494 |

See that? By year 30, compound interest generates over four times the wealth of simple interest! This is the power we'll learn to harness next. It doesn't require genius-level IQ, but extraordinary foresight and discipline.

3: How to Use Our Compound Interest Calculator: A 2-Minute Quick Start Guide (Experience)

The power of theory ultimately lies in its practical application. Now, I invite you to open our Compound Interest Calculator and follow along step by step. You'll discover that harnessing this powerful tool is far simpler than you imagined.

Our calculator interface is clean and minimal, featuring only a few core input fields. Let's break down their purpose one by one—much like understanding your car's accelerator, brakes, and steering wheel.

3-1: Principal Amount:

Your Starting Point: This is straightforward—it's the initial sum you're ready to invest when launching this plan. It could be savings you've built over time or existing funds in your trading account. Remember, there's no such thing as "too little" to begin. I've seen people start with $500 and, through strict discipline, eventually build substantial wealth. What matters isn't how high your starting point is, but whether you're willing to "begin." To me, this number represents more than just money—it embodies your resolve.

3-2: Annual Interest Rate (%):

Your Growth Engine. This is the "engine" powering the entire plan. It represents the average annual percentage return you expect your investment to generate. This figure is where fantasies often take flight, making it crucial to maintain rationality. Many people will enter 50% or even 100% here, then get excited by the projected results. But this is meaningless "number games." A responsible planner will enter a realistic, sustainable figure. So, what is realistic?

Conservative Reference: Purchasing long-term government bonds or high-rated corporate bonds from certain countries may yield returns between 3%-5%.

Market Average Reference: Long-term investment in broad market index funds like the S&P 500 has historically averaged annualized returns of approximately 8%-10% (note: this is historical average, not a guarantee of future performance).

Top Investor Reference: Legendary investors like Warren Buffett have achieved long-term annualized returns of "only" around 20%.

For Traders: If your goal is 2% monthly, that translates to (1.02^12) - 1 annually—roughly 26.8%. This is an exceptionally ambitious and challenging target. When entering this figure, honestly assess your investment strategy and capabilities. A conservative yet achievable goal holds far greater value than a grandiose yet unattainable one.

3-3: Number of Years:

Your Time Horizon This is the most crucial "ingredient" in compound interest magic—time. How long do you want your snowball to roll? 10 years? 20 years? Or 30 years until retirement? The longer the timeframe, the more astonishing the compounding effect becomes. This number will profoundly illustrate the importance of "getting on board early." Try it yourself: the difference between 20-year and 30-year outcomes for the same investment will astonish you. It reminds us that for young people, the greatest asset isn't the money in your hand, but the time ahead.

3-4: Compounding Frequency:

The Accelerator. This option determines how often your interest is calculated and reinvested into the next round of compounding. Annually? Semi-annually? Quarterly? Or monthly? Generally, the higher the frequency, the slightly greater the final return, as it allows your money to participate in reinvestment sooner. For most savings and investment plans, monthly or annual compounding is common. For forex traders, evaluating and calculating compound interest monthly is an excellent practice.

3-5: Monthly Contribution: Your Continuous Fuel

This is a core feature of our calculator and the key distinction between ordinary individuals and professional planners! Relying solely on a lump sum for compounding is insufficient for most people. The "Monthly Contribution" is the amount you commit to adding to the plan each month from your salary or other income, beyond your initial principal. This money continuously adds fresh snow to your snowball, dramatically accelerating its growth. It represents your savings discipline and cash flow management skills. Even adding just $100 monthly creates a massive difference over 30 years. It transforms a static investment plan into a dynamic, continuously growing wealth accumulation system.

Now that you fully grasp these parameters, it's time to design your own plan. Don't hesitate—open [link to your calculator page] now, and let's dive into the hands-on practice in the next chapter!

4: Your Personal Blueprint: 3 Actionable Growth Strategies (Unique Value & Expertise)

With theory and tools in hand, let's integrate them to tackle real-world challenges. This chapter presents three meticulously designed "action blueprints" tailored to distinct life roles and goals. Identify your fit or adapt them to craft your own plan.

4-1: Blueprint A: "The Homeownership Dream" :

Saving for a Down Payment. This is the first major financial goal many of us face. Suppose your target is to save $100,000 for a down payment in your desired city within 5 years. Through several years of work, you've already accumulated an initial principal of $20,000. You plan to invest this money in a relatively stable index fund portfolio, expecting a realistic annualized return of 6%.

The question now is: How much extra money do I need to invest each month to achieve this goal in 5 years?

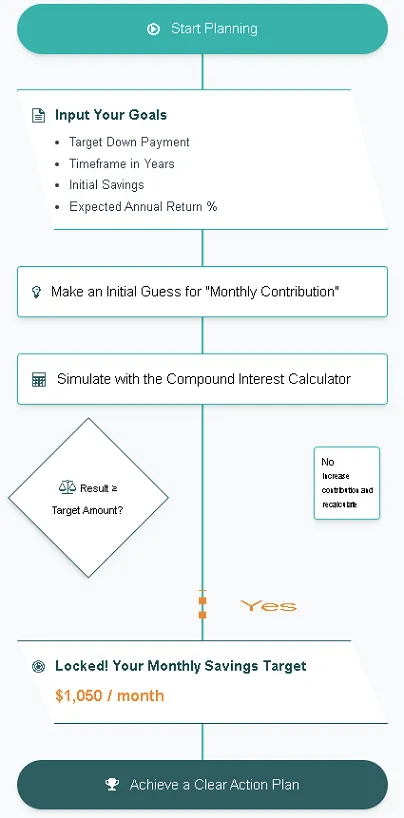

Calculating this manually would be very complex. But with our calculator, you can easily find the answer through trial and error.

4-2: Steps:

1. Open the calculator.

2. Enter Principal Amount: 20000

3. Enter Annual Interest Rate: 6

4. Enter Number of Years: 5

5. Select Compounding Frequency: Monthly

6. Monthly Contribution: This is the answer we seek. Start with an estimated figure, like $1000.

Click "Calculate." The result shows the total after 5 years is approximately $96,980. Very close! But not quite there yet. Let's slightly increase the monthly payment to $1,050. Recalculate, and the total becomes $100,129. Perfect!

Conclusion: To achieve your dream of homeownership, you need to invest $1,050 monthly with strict discipline.

Doesn't this number instantly make your goal crystal clear? It's no longer a distant dream, but a breakable-down, actionable task for each month. You now know your "monthly KPI," allowing you to adjust your spending around it or find ways to increase your income. This is the power of planning: it counters future uncertainty with certainty.

4-3: Blueprint B: The "FIRE Movement" — Charting Your Path to Early Retirement

FIRE (Financial Independence, Retire Early) represents the ultimate dream for many young people today. It means your passive income fully covers your living expenses, freeing you from working solely for money. This is a grander, longer-term goal that truly showcases the power of compound interest.

Scenario: You're 25 years old and full of energy. You aim to achieve financial independence by age 45—20 years from now. You estimate needing $1.5 million in net worth to retire comfortably. Through hard work, you've already saved your first $10,000 "seed fund." You decide to adopt a more aggressive investment strategy: long-term holdings in global stock index funds, targeting an average annual return of 8%.

Core Question: To achieve this ambitious goal, how much should I invest monthly starting now?

Calculator Inputs:

1. Principal Amount: 10000

2. Annual Interest Rate: 8

3. Number of Years: 20 (age 25 to 45)

4. Compounding Frequency: Monthly

5. Monthly Contribution: We'll use trial and error again. Start with $2,000.

Click calculate. Result: $1,225,167. Hmm, still short of $1.5 million. We need to increase the "fuel." Try $2,500.

Result: $1,466,459. Very, very close! Increase it slightly to $2,550. Result: $1,490,588. We've basically made it!

Conclusion: For a 25-year-old aiming to accumulate $1.5 million by age 45, with an 8% annualized return, they must invest approximately $2,550 monthly without fail starting now.

This figure might feel daunting to some. But note there are two variables you can optimize: first, find ways to boost your annualized return rate (e.g., through deeper study and research); second, gradually increase your monthly contributions as your salary grows. This calculator provides dynamic navigation. You can recalculate annually, adjusting your "course" based on actual progress. It acts like your financial "GPS," constantly showing how far you are from your destination and what pace you need to maintain.

4-4: Blueprint C: "Strategic Trader" — A Unique Hybrid Growth Model

Now we arrive at my personal favorite and what I consider the most distinctive feature of our site. If you're a trader in forex, stocks, or cryptocurrency, this blueprint is tailor-made for you.

Traditional traders often focus solely on one thing: how to make more money with the funds in their trading account. They use our "Position Sizing Calculator" or "Risk-Reward Calculator" to manage each trade, which is excellent. But they often overlook another powerful growth engine: combining your off-market earning capacity (like your salary) with your on-market trading capacity!

Scenario: You're a trader with a stable job. Your trading account currently holds $5,000. Your trading system has been refined over time—it won't make you rich overnight, but it consistently delivers an average monthly profit of 2%. You've also decided that after each paycheck, you'll force yourself to contribute an extra $300 to this trading account as additional "fuel." You want to see how your account might grow over 10 years with this "dual-engine" approach.

The calculation here requires a bit of finesse: Our calculator needs the "annualized rate of return." So first, we must convert the "2% monthly" profit into an annual compound return rate. The formula is (1 + monthly rate)^12 - 1. (1.02)^12 - 1 ≈ 0.268, which equals a 26.8% annualized return rate.

Now, plug these numbers into the calculator:

1. Principal Amount: $5,000

2. Annual Interest Rate: 26.8% (This represents the core of our trading capability)

3. Number of Years: 10

4. Compounding Frequency: Monthly

5. Monthly Contribution: $300 (This reflects our OTC savings capacity)

Click "Calculate"—are you ready to be amazed? After 10 years, your account balance will reach $158,166.

Let's break down how this astonishing figure materialized. Over the decade, your total principal investment was: $5,000 (initial) + $300 × 12 × 10 (monthly contributions) = $41,000. Yet your account holds nearly $160,000! This means over $117,000 was created out of thin air through your "trading prowess" and the "magic of compound interest"!

The profound significance of this blueprint lies in offering all traders a fresh, more robust approach. You no longer need to take enormous risks chasing quick riches. You can treat trading as a "high-interest savings account," using a sustainable, low-risk strategy to generate steady monthly returns. Then, use your off-market cash flow to continuously fund this "high-interest account." This model will take you farther and more steadily than gambling everything on chasing windfall profits.

Internal Link Note: I strongly recommend using our website's Risk-Reward Calculator and Position Sizing Calculator when implementing this blueprint. Achieving consistent monthly profits hinges on flawless risk management. Ensuring each trade's loss remains within 1%-2% of your total account balance is the cornerstone of this strategy's success.

5: Reality Check: Navigating Inflation, Taxes, and Unrealistic Expectations (Expertise & Trust)

Friend, if the previous chapter was the thrilling "dream blueprint," this one is the "cold shower" I must give you as someone who's been there. But this water isn't meant to extinguish your passion—it's to make your plan truly viable in the real world. A plan that discusses only gains without addressing risks is fragile and irresponsible.

5-1: The Hidden Enemy: How Inflation "Steals" Your Money

Will the $1.5 million we calculated still be worth $1.5 million twenty years from now? The answer is: absolutely not. Inflation, this "hidden enemy," continuously erodes the purchasing power of our money. Today's $100 may only buy $97 worth of goods next year.

Therefore, when setting return targets, we must factor in inflation. The 8% or 10% returns we commonly discuss are called "nominal returns." The return adjusted for inflation is called the "real return," which truly represents the growth of your purchasing power.

A simplified estimation formula is:

Real Return ≈ Nominal Return - Inflation Rate.

Suppose you achieve an 8% annualized return, but the inflation rate that year is 3%. Your actual purchasing power growth is only about 5%. This means that if you want to have purchasing power equivalent to $1.5 million today in 20 years, your ultimate target amount may need to be set at $2 million or even higher.

What should we do?

1. Raise Awareness: First, recognize its existence. Don't be blinded by the nominal numbers on your calculator.

2. Adjust Goals: When making long-term plans (especially over 10 years), appropriately increase your final target amount to build a buffer against inflation.

3. Beat Inflation: Your investment returns must consistently and sustainably exceed the inflation rate over the long term. Otherwise, your wealth is effectively shrinking. This is precisely why we shouldn't keep all our money in a bank savings account.

5-2: The Silent Erosion: The 20-Year Impact of Inflation on $1,000,000

| Average Annual Inflation | Nominal Value in 20 Years | Real Purchasing Power (in Today's Dollars) |

|---|---|---|

| 2% | $1,000,000 | ~$672,971 |

| 3% | $1,000,000 | ~$553,676 |

| 5% | $1,000,000 | ~$376,889 |

(Note: Real Purchasing Power is calculated as: Future Amount / (1 + Inflation Rate)^Number of Years)

5-3: Don't Forget Uncle Sam: A Tax Reminder

Before celebrating your gains, remember a silent partner may be waiting: the tax authorities. Investment profits may be subject to capital gains tax under your jurisdiction's laws.

This significantly impacts your net returns. For example, if your investment gains are $100,000 and the capital gains tax rate is 20%, you'll only receive $80,000 after taxes.

Taxation is an extremely complex field, with vastly different rules across countries and investment account types (e.g., U.S. 401(k)s, IRAs vs. regular brokerage accounts). I cannot provide specific tax advice here, but as a responsible content creator, I must remind you:

1. Understand your local tax rules: Take time to learn about capital gains tax policies in your jurisdiction.

2. Leverage tax-advantaged accounts: Many countries offer tax-advantaged accounts like retirement plans where investments can be tax-deferred or even tax-free. Maximize these policies whenever possible.

3. Consult professionals: As your investment portfolio grows, hiring a professional tax advisor is absolutely worth the expense.

In our calculator, you can treat tax rates as a "discount." For example, if your expected annualized return is 10% and your tax rate is 20%, you can calculate using an 8% "after-tax return" for results closer to reality.

5-4: A Game of Patience: Why Persistence Matters More Than Intensity. This is the most crucial—and most challenging—aspect. The most vulnerable aspect of a compounding plan is that it demands patience and discipline that run counter to human nature.

In the early stages of the plan, you'll feel immense strain. You scrimp and save each month, investing hundreds or even thousands of dollars, yet after a year, your account seems barely changed—especially during market downturns when losses may even occur. At this point, you'll hear stories of people around you "getting rich overnight" by chasing hot trends and speculating. Your resolve will waver.

"Is my approach too slow?" "Does sticking with this really make sense?"

Let me reinforce your conviction with data. Imagine two people, A and B.

A (Early Starter): Began investing $500 monthly at age 25, consistently for 10 years until age 35. Then stopped contributing entirely, letting the account grow through compound interest.

B (Late Starter): Didn't begin investing until age 35, also contributing $500 monthly. But she worked tirelessly, continuing until retirement at 65—a full 30 years of contributions.

Guess who has more money in their account at age 65? (Assuming an 8% annualized return)

The answer might surprise you:

At age 65, Person A's account totals approximately $950,000. She invested only $500 * 12 * 10 = $60,000 in total.

B's account balance at age 65 is approximately $745,000. She invested a total of $500 * 12 * 30 = $180,000.

A invested only one-third of B's principal and persisted for one-third of the time. Yet simply by starting 10 years earlier, her final wealth exceeded B's by over $200,000!

This is the truth of the "patience game." In the world of compound interest, when you start matters far more than how much you invest. What you must conquer isn't the market, but your own impatience and doubt. Print out your plan and pin it to your wall. Engrave that long-term, astonishing target figure into your mind. When you waver, come back and revisit this case study—it will give you the strength to persevere.

6: Important Disclaimer and Risk Warning

Important Notice and Disclaimer

Hey there. Before proceeding, I must seriously emphasize the following points:

1. Educational Purpose: All results from this article and the calculators provided on this site are simulations based on the mathematical models you input. They are intended solely for educational and informational purposes. They are not, and should not be construed as, any form of financial, investment, legal, or tax advice.

2. "Garbage In, Garbage Out": The accuracy of the calculators depends entirely on the validity of your input data. Entering unrealistic expectations will only yield false and meaningless results.

3. Investing Involves Risk: All investments, including forex, stocks, etc., carry significant risk of principal loss. Past performance, whether historical data or your personal trading history, does not predict future returns. Markets are unpredictable.

4. Non-Professional Advice: As the site administrator, I share insights based on personal experience and study. I am not a licensed financial advisor or planner. Before making any major decisions that could impact your financial situation, you must consult a qualified, licensed professional.

5. Tool Limitations: Our calculator is a simple, offline mathematical tool. It does not connect to real-time market data, does not provide live exchange rates, and cannot guarantee the success of any investment strategy.

7: My Perspectives and Insights: Thoughts Beyond the Calculator

After discussing technical and strategic aspects, I'd like to conclude by sharing deeper reflections on the "Way" of finance. As someone who interacts with these numbers daily, I increasingly believe a good financial calculator's true value extends far beyond mere computation.

To me, this small calculator functions more like a "mirror" and a "compass."

It's a "mirror" because when you input numbers, it honestly and impartially reflects your current financial situation and behavioral habits. How much can you save each month? This reveals your spending discipline. What return rate do you expect? This reflects your knowledge level and risk tolerance. How many years are you willing to commit to your goals? This shows your patience and foresight. You cannot deceive yourself before this mirror. It forces you to confront who you truly are: a moonlighting spender or a saver? A speculator or an investor? Short-termist or long-termist?

It serves as a "compass" because once you understand yourself, it charts your course toward the future. When you set a goal—say, "retire at 45"—this compass calibrates your direction. It tells you what "speed" (monthly contribution) you need to maintain and what "route" (investment strategy) to choose to reach that destination. On a long, monotonous voyage, it's easy to lose your way. But as long as you regularly consult this compass, you'll know you're not drifting off course. You'll understand that every effort brings you one step closer to the shore. This sense of certainty provides powerful psychological energy to keep going.

I also want to emphasize: beware of equating "calculation" with ‘investment’ itself. Calculation is static and idealized; investment is dynamic and fraught with uncertainty. The real investment world is far more complex and chaotic than the numbers on a calculator. Markets panic, companies fail, black swans strike. So we mustn't become mere "calculator masters" who only theorize on paper. What calculators provide is a strategic blueprint. To win on the real battlefield, we also need tactical skills: rigorous risk management, continuous learning capabilities, and most crucially—a resilient mindset capable of weathering market volatility.

So, use this tool wisely, but don't worship it. Employ it to chart your broad direction, then invest more energy into enhancing your "growth engine" (your professional skills, your trading system, your investment knowledge) and fortifying your "mental defenses." Ultimately, what determines the height of your wealth isn't the calculator, but the person sitting in front of the screen—the one who keeps learning, reflecting, and growing.

8: Summary: You Have the Map—Now It's Time to Set Sail

Friend, thank you for reading this far. Let's quickly recap today's journey:

We grasped the astonishing power of compound interest—that "snowball effect."

We learned how to use a simple yet powerful compound interest calculator.

We mapped out clear action plans for three core goals: "buying a home," "retirement," and "trading growth."

We've also gained a sobering awareness of real-world challenges like inflation, taxes, and maintaining patience.

Now, you're no longer lost with just a vague dream. You hold a "financial map" tailored specifically for you. You know your starting point, see your destination clearly, and most importantly, you've mapped out the path to get there.

Actionable Advice: Knowledge is worthless unless put into action. My final and most crucial advice is this: Don't let this plan remain only in your mind or on a browser page.

1. Take Action Now: Open [link to your calculator page] immediately and calculate your personalized "monthly contribution" based on your actual circumstances.

2. Automate Execution: Set up a monthly automatic transfer or regular investment plan within your bank or brokerage app. Remove the decision-making process from your emotions and let the system enforce discipline for you.

3. Regular Review: Return here every six months or year to reassess and adjust your plan.

Remember, the greatest voyages begin with the smallest departure. The small step you take today, amplified by the compounding effect of time, will become a giant leap in your future life.

Final Risk Warning: Please remember that investing involves risks, and market entry requires caution. All content herein is for educational purposes only and does not constitute investment advice. Seek professional guidance before making any financial decisions.

Recommended Further Reading:

To build a more comprehensive financial knowledge system, I strongly recommend continuing your exploration with several in-depth articles on our website:

Stock Market Return Calculator: Free CAGR Guide

All-in-One Position Size Calculator: Stocks, Crypto, Futures

References:

Investopedia. "What Is the Average Annual Return for the S&P 500?"

Leave a Comment: