(You can click here to use the Lot Size Calculator or read this guide)

Hey there, friend! Welcome to this space.

I bet you've been there—just like me—staring at those flickering candlestick charts late at night, heart pounding. Especially when trading volatile beasts like US30 (Dow Jones) or NAS100 (Nasdaq 100), have you ever wondered, "How many lots should I actually trade?"

I'll never forget one afternoon early in my trading career. I spotted what felt like a perfect long opportunity on the NAS100, brimming with confidence that I'd grasped the pulse of the market. I entered what I thought was a "reasonable" position size and went about my business. Hours later, when I reopened my trading platform, I froze—a sharp market pullback had pushed my account losses far beyond expectations. That single trade nearly wiped out a month's profit. It felt like a bucket of ice water dumped over my head, jolting me awake. I'd made the most common—and deadliest—mistake of a novice: I'd sized my position based on gut feeling, not calculation.

From that day on, I vowed never to let it happen again. I threw myself into studying risk management, poring over complex calculation formulas. I discovered that precise position sizing is the dividing line between professional traders and gamblers. But the process was agonizing—searching for contract specs, calculating pip values, plugging numbers into formulas before every trade... it was killing my trading intuition! So I decided to create a simple, pure, ad-free website for myself and all traders who've struggled like me, offering a suite of practical trading calculators.

This article is the product of that painful lesson. I'll share everything I know about precisely calculating position sizes for US30, NAS100, and futures contracts. More importantly, I'll show you how to use our free tools to complete this critical step in seconds, freeing your mind to focus on trading decisions. Trust me—after reading this, you'll banish all confusion and fear about position sizing.

1: What Is Position Size? Why It's Your "Capital Guardian"

Before diving into calculations, we must take a moment to truly grasp the weighty significance of the term "position size." Many view it as merely a number, but in reality, it's the "volume knob" of your trading world—turn it too high, and it shatters your account; turn it too low, and you might not even hear the market's beautiful melody. It isn't an isolated concept but the cornerstone of your entire risk management system—the one variable you can control 100% in an uncertain market. In my view, trading success begins with reverence for position sizing.

1-1: Starting with the Basics: Standard Lots, Mini Lots, and Micro Lots

Let's understand this with a simple analogy. Imagine buying eggs at the supermarket. You can purchase a full carton (12 eggs), half a carton (6 eggs), or just one egg. In financial trading, a "lot" serves as this standardized unit of trade. Different lot sizes represent varying scales of your trade and its potential risk-reward profile.

Standard Lot: Typically represents 100,000 units of the base currency. This is the unit commonly used by institutions and professional traders. For most retail traders, directly trading standard lots carries extremely high risk—akin to a novice driver immediately racing an F1 car.

Mini Lot: Represents 10,000 units of the base currency, one-tenth of a standard lot. It offers more flexible options for traders with moderate capital.

Micro Lot: Represents 1,000 units of the base currency, one-tenth of a mini lot. This is the ideal companion for beginners and those conducting small-scale test trades. It allows you to gauge market sentiment and validate your trading strategy with minimal risk exposure.

For indices (e.g., US30, NAS100) and futures, the concept of "lots" is tied to contract specifications (Contract Size), which we'll explore in detail later. However, the core principle remains consistent: selecting the appropriate trading unit is the first step in risk management. I strongly recommend starting with micro lots if you're new to trading or testing a new strategy. Remember, staying in the game matters more than how much you profit in a single trade. Often, trading failures stem not from flawed strategies but from mismanaged positions—one mistake can eliminate your chance to return to the table.

1-2: Why is it the core of risk management? — Your only controllable variable

Now, let's delve deeper. Why do I emphasize position sizing so strongly? Because the trading world is filled with uncontrollable factors: you can't predict whether the market will rise or fall in the next second, you can't control how breaking news impacts the market, and you can't even guarantee your stop-loss will always execute precisely. Amid all this chaos and uncertainty, the one thing—and only thing—you can fully control before placing an order is: how much loss am I willing to bear if I'm wrong? Converting this "willingness to lose" into concrete trading units is precisely what position sizing calculates.

Imagine your trading account is a ship, and the market is a stormy sea. Your stop-loss level is your self-imposed "abandon ship" signal, telling you the storm is too fierce and you need to evacuate temporarily. Your position size determines how sturdy your hull is. If the position is too large, even a small wave (normal market fluctuation) could capsize your ship (leading to massive losses or margin calls). If the position is too small, even if you sail far (catching a major trend), you're merely drifting on the surface without substantial gains.

Precise position sizing enables you to:

1. Equalize risk: Whether trading a calm currency pair or the volatile NAS100, adjusting position size ensures each trade's potential loss remains a constant percentage of your total capital (e.g., 1% or 2%). This frees you from fearing specific instruments, allowing you to evaluate all trading opportunities by a uniform standard.

2. Emotional stabilization: Knowing that even if a trade hits your stop-loss, the loss represents only a small fraction of your total account balance brings immense peace of mind. You won't obsessively stare at the screen, panic over normal price pullbacks, or impulsively move your stop-loss during a loss. This emotional stability is the foundation for rational decision-making. My personal experience is that since strictly implementing position sizing, my trading execution has improved by leaps and bounds.

So remember this principle: Position size isn't about calculating how much you can profit, but defining how much you can afford to lose. This is a fundamental shift in mindset and a crucial step from amateur to professional.

2: "Monk Mode": How to Manually Calculate Position Size?

Before creating this website, I was that "monk." Before every trade, I'd perform a series of calculations in my little notebook. Even with tools available now, I firmly believe every trader should understand the logic behind manual calculations at least once. It deepens your grasp of risk and makes you appreciate the convenience tools provide. This process is like learning to drive. Even though most cars are automatic now, understanding how the clutch and accelerator work together makes you a better driver.

The core formula for manual calculation is actually quite straightforward:

Position Size (Lot Size) = (Total Account Balance × Risk Percentage) / (Stop Loss Distance × Value Per Pip)

Let's break down each component of this formula:

1. Account Size: This is the total amount of money in your trading account. For example, $5,000.

2. Risk Percentage: This is the maximum acceptable loss ratio you set for this trade. Professional traders typically recommend keeping it between 1% and 2%. If you choose 1%, your risk amount is $5,000 × 1% = $50. This means if the trade goes wrong, you'll lose no more than $50.

3. Stop Loss Distance: This is the distance between your entry price and your stop loss price, usually measured in "points." For example, if you plan to buy NAS100 at 18,000 points and set your stop loss at 17,950 points, your stop loss distance is 18,000 - 17,950 = 50 points.

4. Value per Point: This is the trickiest and most error-prone part! It refers to the profit or loss amount incurred per standard unit traded when the market moves one point. This value depends on the instrument you're trading, your broker, and the contract specifications.

For example, suppose you're trading an index CFD (Contract for Difference) where the contract specifies that each 1-point movement is worth

1 per lot traded. Then, your position size =(5000 × 1%) / (50 pips × $1/pip) = $50 / $50 = 1. Here, "1" may represent 1 lot or 1 contract unit, depending on your broker's definition.

What's the pain point of manual calculation?

This formula looks simple, but the devil is in the details—especially determining the "value per pip."

1. For forex, you must factor in cross-currency conversions, which can be highly cumbersome.

2. For indices (e.g., US30, NAS100), CFD contracts offered by different brokers may have entirely different point values. Some are $1/point, others $0.1/point, or even variable. You must meticulously check the product specifications within your trading platform.

3. Futures are even more complex. They don't use "point value" but "tick value" (the value of the smallest price movement). You need to know the contract's minimum tick size and its corresponding dollar value.

I recall one instance where I miscalculated a futures contract's tick value, resulting in a position ten times larger than intended! Fortunately, I caught it in time—the consequences could have been disastrous. It was precisely these tedious, error-prone steps that convinced me we needed a tool to end this chaos. Manual calculations help you grasp the principles, but they shouldn't become an obstacle to your trading.

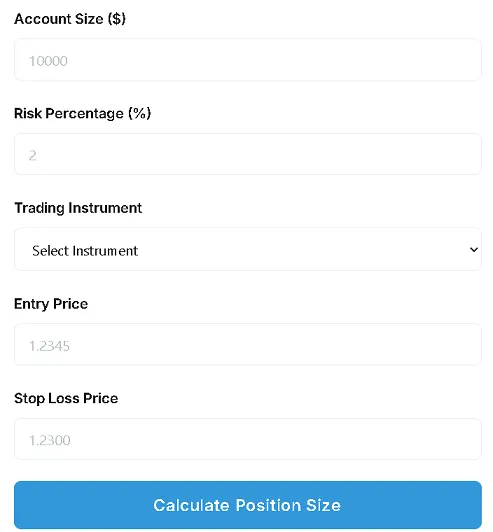

3: "One-Click, Worry-Free" Mode: Use Our Free Position Sizing Calculator

Welcome to the modern world! Say goodbye to tedious calculations and potential errors. To free you from "monk mode," we've developed this incredibly simple, straightforward position size calculator.

You might notice our calculator's interface is remarkably clean compared to industry giants. Yes, that's intentional. No flashy real-time rates (they slow things down and aren't essential for position calculations), no complex API integrations, no annoying pop-up ads. It has one mission: deliver the most accurate answer at lightning speed after you input just a few core parameters. It's like that trusty screwdriver in your toolbox—unassuming, yet always ready to tackle the job when it counts.

How to use it? Super simple, just four steps:

1. Account Size ($): Enter your total account balance.

2. Risk Percentage (%): Enter the percentage of risk you're willing to take on this trade (we strongly advise beginners not to exceed 1%).

3. Entry Price: Your planned entry price.

4. Stop Loss Price: Your stop loss price.

Now for the most crucial step:

Trading Instrument: Here, you need to know the value per pip for your trading instrument. This is the dollar value per pip movement for one lot (or one contract) of that instrument at your broker.

Important Note: This "tick value" is the only external information you need to obtain. You can find it in your trading platform (e.g., MT4/MT5) by right-clicking the instrument, selecting "Specification," and locating details like "Contract Size" or "Tick Value." We'll guide you through finding and understanding this in the next section.

Once you input these values, the calculator instantly shows you:

The amount of risk you can afford (Money to Risk)

The number of points for your stop loss (Stop Loss in Points)

The final recommended position size (Position Size)

See? It's that simple! In just seconds, you'll get a scientifically managed, risk-based position size tailored to you. Now, let's dive into the real action and see how to apply this tool to the hottest—and trickiest—markets.

4: Specialized Breakthrough: Practical Guide to Calculating Positions for US30, NAS100, and Futures

This section forms the core of this article and distinguishes us from all other generic calculator pages. We will walk you step-by-step through the entire process of calculating positions for these challenging instruments.

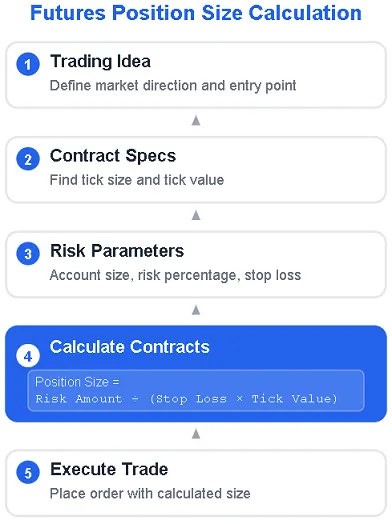

4-1: Futures Lot Size Calculator: Position Calculation Guide

Trading futures—such as crude oil (CL), gold (GC), or stock index futures (ES, NQ)—involves fundamentally different position calculation logic compared to forex and CFDs. The key lies in understanding the concepts of "Contract" and "Tick".

Contract: The basic unit of futures trading is the "lot" or "contract". You trade not in "lots," but in "1 contract," "2 contracts," etc.

Tick: This is the smallest unit of price movement for a futures contract.

Tick Value: This is the dollar value per contract corresponding to a one-tick price change.

This information is standardized and set by the exchange. For example, the most authoritative data can be found on the official website of the **CME Group (Chicago Mercantile Exchange)**.

Practical Example: Trading E-mini Nasdaq 100 (NQ) Futures

Suppose you wish to trade NQ futures. First, locate its contract specifications on the CME website (also accessible via your futures trading software).

Contract Unit: E-mini Nasdaq-100 Futures

Minimum Price Fluctuation (Tick Size): 0.25 index points

Tick Value: $5.00

This means that for every 0.25-point movement in the NQ price, the value of one contract changes by $5. In other words, for each full index point (1.00) the NQ moves, the value of one contract changes by $5 / 0.25 = $20.

Now, assume your scenario is:

Account Balance: $25,000

Risk Preference: 1% (i.e., $250)

Plan to go long at 18,000 points

Stop-loss set at 17,975 points

Stop-loss distance: 18,000 - 17,975 = 25 index points

Manual calculation:

Total Risk Amount: $250

Potential loss per contract within stop distance: 25 points × $20/point = $500

Number of contracts you can trade: $250 / $500 = 0.5 contracts

Since futures contracts typically cannot be traded in half-lots, trading 1 full contract would be too risky for you. You need to find a smaller contract, such as the Micro E-mini Nasdaq-100 (MNQ). The MNQ contract size is 1/10th of the NQ, with a per-point value of $2.

Recalculating with Micro contracts:

Potential loss per Micro contract within stop-loss distance: 25 pips × $2/pip = $50

Number of Micro contracts you can trade: $250 / $50 = 5 contracts

See? By understanding contract specifications, we've developed an actionable trading plan: You can trade 5 MNQ contracts.

4-2: US30 Lot Size Calculator: The Art of Position Sizing for the Dow Jones Index

For the vast majority of retail traders, the US30 (or DJ30) we trade is actually a CFD (Contract for Difference), not the underlying index itself. This raises a critical issue: CFD contract specifications can vary dramatically between brokers!

This is the most common pitfall for beginners. Broker A's 1 lot of US30 might have a tick value of 1/point, while Broker B's 1 lot of US30 may have a tick value of 10 pips. If you fail to distinguish these differences and blindly copy someone else's position size, the consequences could be disastrous.

How do you determine your US30 tick value?

1. Open your MT4/MT5 trading platform.

2. In the "Market Watch" window, locate US30 (or similar names like DJ30, WallSt30).

3. Right-click and select "Specification."

4. In the pop-up window, locate "Contract Size" or a similar description.

If Contract Size is 1, trading 1 lot typically means a $1 profit or loss per 1-point index movement.

If Contract Size is 10, trading 1 lot means a $10 per-point value.

Practical Example: Trading US30 CFDs

Assume your situation is:

Account balance: $10,000

Risk tolerance: 1.5% (i.e., $150)

Plan to short at 39,000 points

Stop-loss set at 39,050 points

Stop-loss distance: 50 points

Upon checking, you find your broker's US30 contract has a point value of $1/point per lot.

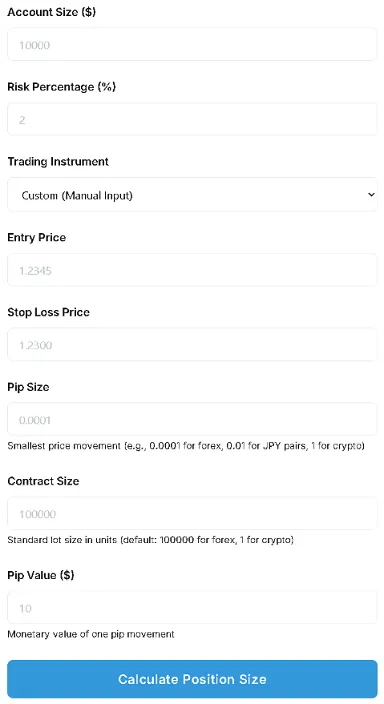

Now, here's the real deal!You might be wondering: "My broker offers US30 contracts with unusual tick values—can your calculator handle that?" Good question! This is precisely where our calculator shines compared to those rudimentary tools on the market.

We've specifically designed a powerful "Custom" mode to tackle this issue perfectly.

With our calculator, you no longer need workarounds or guesswork. Just follow these precise steps:

1. In the calculator's "Trading Instrument" dropdown menu, select "Custom"**.

2. You'll see several additional input fields appear: Pip Size, Contract Size, Pip Value. Don't worry, I'll explain each one step by step—they're very straightforward.

Important: How to determine these parameters for US30?

The only homework required is to retrieve your broker's contract specifications from your trading platform (e.g., MT4/MT5). This takes just 30 seconds:

1. Locate US30 (or DJ30, WallSt30, etc.) in the "Market Watch" window.

2. Right-click and select "Specification".

3. In the pop-up window, locate the key information, primarily the **"Contract Size"**.

Now, let's fill in the calculator's parameters:

1. Pip Size: For indices like US30 or NAS100, the smallest integer unit of price movement is 1 (e.g., from 39000 to 39001). So enter 1 here.

2. Contract Size: This is the most critical number! Enter the exact "Contract Size" you see in your broker's specifications.

If it shows 1, enter 1.

If it shows 10, enter 10.

3. Pip Value: This parameter is for handling more complex forex crosses. For dollar-denominated index CFDs, simply enter 1. Our calculator will automatically compute the correct pip value using the Contract Size above.

Practical Example: Trading US30 CFD (Using Custom Mode)

Let's revisit the previous example, but this time using our powerful "Custom" mode to see how clear everything becomes:

Account Balance: $10,000

Risk Preference: 1.5% (i.e., $150)

Plan to short at 39000 points

Stop Loss set at 39050 points

Stop Loss Distance: 50 pips

Upon checking, you find your broker's US30 contract has a **Contract Size of 1**.

Now, open our calculator and input the following:

Account Size: 10000

Risk Percentage: 1.5

Trading Instrument: Select Custom

Entry Price: 39000

Stop Loss Price: 39050

Pip Size: Enter 1

Contract Size: Enter 1 (based on information obtained from your broker)

Pip Value: Enter 1

Click "Calculate," and the result appears instantly: you should trade 3 lots.

Another scenario:

What if your broker's specifications show a "Contract Size" of 0.1? Simple—just enter 0.1 in the Calculator's Contract Size field while keeping all other parameters unchanged. The calculator will tell you to trade 30 lots.

See? No matter how "unusual" your broker's contracts may be, as long as you find that crucial "Contract Size" figure, our calculator will provide you with precise position sizing recommendations. This "Custom" feature is your ultimate weapon for mastering all non-standard trading instruments!

NAS100 Lot Size Calculator: The Ultimate Guide to Taming the Tech Giant

Ah, NAS100, my "old friend"—it taught me the most painful yet invaluable lesson. NAS100 is renowned for its massive volatility, meaning it offers tremendous opportunities while harboring immense risks. For this instrument, precise position sizing isn't optional—it's essential for survival.

Just like with US30, you first need to determine the pip value of the NAS100 CFD contract you're trading. The steps are identical, so I won't repeat them here. Let's dive into something deeper—and often overlooked—by most articles: how to set a "reasonable" stop loss distance for NAS100?

Set your stop too close, and you'll be easily swept out by normal market "noise"; set it too far, and it will compromise your risk-reward ratio while forcing you to use minuscule positions. My experience suggests using the **ATR (Average True Range)** indicator as an excellent starting point.

ATR reveals the average market volatility over a recent period (typically 14 periods). For example, if the NAS100's ATR(14) on a daily chart is 300 points, this indicates its average daily price range is roughly 300 points. You can set your stop loss at 1x, 1.5x, or 2x the ATR distance from your entry price.

Ultimate Practical Exercise: Combining ATR with a Calculator

Let's revisit the scenario from my initial loss story, but this time with a professional approach.

1. Account Balance: $5,000 (Back to the starting point)

2. Risk Preference: Strict 1% (i.e., $50)

3. Trading Instrument: NAS100 CFD (Assuming a $1/point value per inquiry)

4. Trading Idea: Identified strong support near 18,000 points, planning to go long.

5. Setting Stop Loss: Opening the daily chart, I observed the ATR(14) value was approximately 250 points. I decide to give the market some breathing room, setting the stop loss about 0.5 times the ATR below the entry price—roughly 125 pips. Thus, my stop loss is set at 18000 - 125 = 17875.

6. Stop Loss Distance: 125 pips.

Now all parameters are ready. We open our free position sizing calculator:

1. Account Size: 5000

2. Risk Percentage: 1

3. Entry Price: 18000

4. Stop Loss Price: 17875

5. (Assuming the calculator automatically calculates stop loss points and value per point, or we input them manually)

Stop Loss (in points): 125

Value per point: 1

The calculator instantly displays the result:

Money to Risk: $50

Position Size: 0.4 lots

See? Not the 2 lots I instinctively took back then, nor 1 lot—but precisely 0.4 lots! This means if the market plunges again like that day and hits my stop loss at 17875, my loss will be 1% of my account—exactly.

50. Not 50. Not 500, not 1000 but 1000, but 50. I can fully accept this outcome and calmly seek the next trading opportunity.

This is the difference between professional and amateur. This is control. This is how trading should be.

5: From Calculation to Strategy: Integrating Position Sizing into Your Trading Workflow

Having a good calculator is like wielding a sharp sword, but you must also learn how to incorporate it into your swordplay techniques. Isolated position calculations are insufficient—they must become part of your comprehensive trading plan. Let me show you how a professional trader thinks before placing an order, and how other tools on our website can assist you in this process.

A complete trading decision process should look like this:

1. Identify Opportunities: Generate a trade idea through your analysis (technical, fundamental).

2. Define Key Levels: Clarify your entry point, stop-loss level, and profit target.

3. Evaluate Risk/Reward Ratio: Here, you can use our Risk/Reward Calculator. Input your entry, stop-loss, and target prices, and it will tell you if the trade is "worth it." Typically, we aim for a risk/reward ratio of at least 1:1.5 or 1:2. Why risk a trade if the potential profit is less than the potential loss?

4. Calculate Position Size: This is the step we just discussed in detail. Use our Position Size Calculator to determine the precise number of lots based on your risk tolerance and stop-loss distance.

5. Check Margin: After calculating your position size, ensure your account has sufficient margin to open the trade. This is where our Margin Calculator comes in handy. It reveals how much margin this trade will consume and how much usable margin remains, preventing you from being unable to open a position due to insufficient margin or facing margin calls from overleveraging.

6. Execute the Trade: Only when all preceding steps are verified, risks are controlled, returns are reasonable, and margin is sufficient should you finally click "Buy" or "Sell."

7. Post-Trade Management: Let the trade run its course while adhering strictly to your stop-loss and take-profit plans.

See? Position sizing isn't isolated—it bridges your trading ideas to execution and serves as the core hub of your risk management system. By combining different calculators on our website, you gain a complete, automated decision-support system. This system helps you overcome emotional interference, enabling consistently rational, data-driven decisions. My original purpose in creating this website was to provide such a comprehensive "decision dashboard," empowering every ordinary trader to think and act like a professional.

6: My Personal Perspective and In-Depth Insights

At this point, I want to step beyond purely technical instruction and share some heartfelt thoughts. Over the years, I've seen too many intelligent traders who can draw the most complex charts and recite every candlestick pattern, yet still lose money in the market. Why? Because they devote 90% of their energy to "predicting the market" while spending only 10% on "managing themselves." Position sizing is precisely the most crucial element in the art of "managing oneself."

In my view, the essence of position sizing is the wisdom of acknowledging your potential for error. Every time you meticulously calculate your position, you're subconsciously telling yourself: "My judgment might be wrong. The market might not play out according to my script. Therefore, I must prepare Plan B in advance." This mindset transforms you from a gambler chasing "perfect predictions" into a risk manager leveraging "probability advantages." This is the true essence of trading.

The calculator's greatest value isn't in the numbers themselves, but in forcing you to pause and think. When greed or fear clouds your judgment and you're tempted to go all-in, it acts like a level-headed friend, patting your shoulder and saying: Hey buddy, according to your plan, you can only afford to lose 50 bucks this time. That corresponds to a 0.4 lot position. Are you sure you want to do this?" This "forced calm" mechanism has saved my account countless times throughout my trading career.

So don't just see this tool as a calculator. Instead, view it as:

Your Discipline Enforcer: It transforms your risk management rules from mere slogans into actionable steps.

Your Emotional Stabilizer: It neutralizes your inner greed and fear with cold, hard numbers.

Your Professionalism Litmus Test: Whether you use it before every trade directly reflects your professional attitude toward trading.

I'm no financial guru with fancy certifications—just an ordinary trader and a webmaster who loves coding. These tools I build don't connect to any exchange APIs, don't offer real-time rates, and certainly can't export Excel reports. I believe those flashy features add complexity rather than help with the core decision-making process before placing an order. What I want is the purest, fastest, and most reliable calculation. I believe this is what you need most.

Summary and Actionable Recommendations

Alright, friends, we've covered a lot today. Let's quickly recap the key points:

1. Position sizing is the core of risk management—it's the only variable you can fully control in the market.

2. Manual calculations help you understand the principles but are tedious and error-prone.

3. Our free calculator delivers scientifically sound position recommendations in seconds—especially for US30, NAS100, and futures—provided you correctly input the "value per point/tick."

4. Combining tools like ATR to set stop-losses makes your trading plan more rational.

5. Integrate position sizing into your full workflow alongside risk-reward and margin calculators to build your professional decision-making system.

Now, I want you to do more than just bookmark this article. I want you to take immediate action:

Action 1: Go to our Position Size Calculator page and add it to your browser bookmarks. Make it a mandatory stop before every trade.

Action 2: Open your trading platform and locate your most frequently traded instrument (whether US30, NAS100, or others). Using the method outlined in this article, find and record its "contract size" and "point value." Only by completing this homework can you truly master this tool.

Action 3: On your next trade, no matter how confident you feel, strictly execute based on the calculated results. Experience firsthand the inner peace that comes from controlling risk.

Compliance & Risk Warning

Before concluding, I must remind you with the utmost seriousness: This article and all calculators and information provided on this website are for educational and reference purposes only and do not constitute any investment advice. Trading financial markets, especially leveraged CFDs and futures, carries a high level of risk and may result in the loss of your entire investment capital. Before making any trading decisions, ensure you fully understand the associated risks and consult an independent financial advisor. Past performance is not indicative of future results. Trade cautiously and within your means.

Continue reading to deepen your knowledge system.

Mastering position sizing is merely the first step on your professional trading journey. To build a more comprehensive knowledge system, I strongly recommend continuing your reading with several other in-depth articles on our website. They perfectly complement today's content:

Risk/Reward Calculator: Is This Trade Worth Taking?: Learn how to evaluate a trade's "value for money," making every move more valuable.

Margin Calculator: Understanding Your Leverage and Exposure: Gain a deep understanding of how margin works to avoid forced liquidation due to misunderstanding the rules.

Compound Interest Calculator: Visualizing Your Growth Potential: See the astonishing long-term compound growth your account can achieve through strict risk management and consistent profitability.

Thank you for taking the time to read this lengthy article. I sincerely hope my experience and our website's tools help you navigate your trading journey with greater stability and reach further. If you have any questions, feel free to reach out anytime. Wishing you successful trades!

References:

CME Group. "E-mini Nasdaq-100 Futures Contract Specs"

Leave a Comment: