(You can read this guide or click the link to the calculator pages: Margin Calculator or Position Size Calculator)

Author: Qaolase

Bio: I’m an independent trader with 10+ years of live-market experience in stocks, futures, and forex who taught myself to code to escape repetitive, error-prone math. I turned the ultra-fast, battle-tested calculators I built for my own desk into FinWiz—now shared with the global trading community as clean, distraction-free, and proven tools.

Ⅰ. 30-Second Answer: Understanding Lot Sizes and Margin Requirements at a Glance

Bro, I know you're probably staring at that little MT4 window right now, finger hovering over the "New Order" button, feeling a bit unsure—"How much margin should I actually put down?"

Don't worry, I'll give you the answer first, then break it down step by step. This table below shows the results I calculated at 2 AM using my custom "little calculator," with consistent conditions: USD account, 1:30 leverage, EUR/USD market price 1.1050. Just copy these values:

| Lot Size | Required Margin (USD) | Percentage of 10k Account |

|---|---|---|

| 0.01 | 36.83 | 0.37 % |

| 0.10 | 368.33 | 3.68 % |

| 1.00 | 3 683.33 | 36.8 % |

Remember this rule of thumb: "For one standard lot of EUR/USD with 1:30 leverage, you'll need roughly $3,700 in margin." Burn this number into your memory, and you'll instantly estimate any lot size: 0.3 lots ≈ $1,100, 0.05 lots ≈ $185. The margin of error is less than $5—faster than grabbing a calculator.

Someone once asked me: "Why must we remember $3,700?" I countered, "Do you remember braking distance when driving?" It's the same principle—margin is your braking distance. Without a clear grasp, a market jolt could send you crashing into a rear-end collision—account liquidation.

Here's a tip: Break 3,700 into "3-7-0-0" and chant "Three-seven-zero-zero"—it rhymes and sticks. I memorized it by repeating it ten times on the subway back then, and I've never forgotten it since.

Ⅱ. Why Do Manual Calculations Always Go Wrong? Today I Must Share 3 Major Pitfalls I Fell Into

2-1 One: Mixing Up Contract Units

June 18, 2019, is etched in my memory. That day, I confidently jumped into XAUUSD with a 0.5-lot long position. My account equity was $5k, and leverage was 1:100. Using my forex-trained math, I calculated the margin: 0.5 × 100,000 × 1420 / 100 = $710 USD. That was only 14%—plenty of cushion! Then, just three minutes after the market opened, the price flash-crashed by $6, triggering my stop-loss immediately.

I was stunned, utterly baffled: What just happened? Only after reviewing the trade and digging deeper did I realize—one lot of gold equals 100 ounces, not 100,000 contracts! The correct calculation is: 0.5 × 100 × 1420 / 100 = 710 USD. While the numbers appear similar, a $1 fluctuation in gold equates to a $1 profit/loss. I mistakenly assumed 1 pip was $0.1, resulting in a 10x larger risk exposure. After a series of aggressive trades, my account equity dwindled to 50%.

Since then, I've taped "Contract Sizes" next to my monitor: FX 100k, Gold 100 oz, BTC 1 coin, Crude Oil 1,000 barrels. I glance at it for ten seconds every day before placing orders. Before each trade, I double-check—same mistake twice is unacceptable.

2-2 Two: Getting the Exchange Rate Direction Wrong

If USD/JPY is quoted at 149.50 and your account is in USD, no conversion is needed. But if it's in EUR, you must divide by the current EUR/USD rate. Unfortunately, 90% of YouTube tutorials gloss over this step—and that's exactly where I got stuck back then.

When I first traded GBP/JPY with an EUR account, I impulsively calculated margin using the GBP/JPY quote—overestimating it by 12%. Mistaking this for safety, I added 0.3 lots. Waking up the next morning, my Margin Level was 64%, nearly triggering another forced liquidation.

Correct Method:

1. Convert the cross pair's notional value to USD: GBP/JPY 1 lot = 100k GBP × GBP/USD 1.275 = 127,500 USD

2. Divide the USD value by leverage: 127,500 / 30 = 4,250 USD

JPY is just a distraction—the core factor is the GBP/USD exchange rate. Write this on a sticky note, post it on your computer screen, or set it as your phone wallpaper to constantly remind yourself!

Three: Treat Leverage as a "Profit Amplifier"

Leverage only determines margin requirements, not profit/loss points! 1:500 reduces required margin to 1/5, but 1 pip is still worth 1 USD (for 1 lot). Many assume 1:500 means "slower losses," but it actually triggers margin calls faster.

In 2020, I tested 1:500 on a demo account: 0.2 lots of EUR/USD required just 44 USD margin. I was thrilled: This leverage feels amazing! Then a 25-pip move against me wiped out 50% of my account. I was secretly pleased, thinking "just 25 pips? No big deal." The higher the leverage, the lower your margin for error—a slight price swing can wipe out your capital. Now I only use 1:30 leverage. I sleep soundly and never wake up in the middle of the night in a panic.

Ⅲ. 5-Step Formula (Calculate Without Real-Time Prices)

3-1 Standard Lot USD-Based

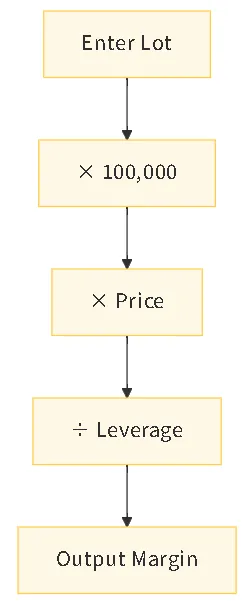

Required Margin = Lot × 100,000 × Price / Leverage

Example: 0.2 lot EUR/USD at 1.1050 with 1:30 leverage

Required Margin = 0.2 × 100,000 × 1.1050 / 30 = 736.67 USD

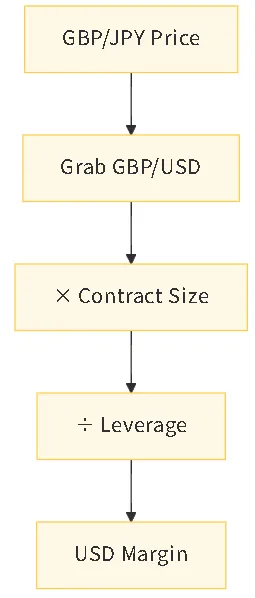

3-2 Cross-Currency Bid-Ask Conversion Method (GBPJPY + USD Account)

1. First find GBPUSD spot rate → 1.2750

2. Then find USDJPY → 149.50 (for verification only)

3. Margin = 100,000 × Lot × GBPUSD / Leverage

The result remains denominated in USD and is actually unrelated to JPY. Don't be intimidated by the dual quotes—the logic is extremely simple. Don't get yourself confused.

3-3 Margin Calculation for Precious Metals & Cryptocurrencies

1. XAUUSD Contract = 100 oz

0.5 lot, current price $1,950, leverage 1:20, required margin = 0.5×100×1950 / 20 = $4,875

2. BTCUSD Contract = 1 coin

0.3 lot, current price $26,500, leverage 1:10, required margin = 0.3×1×26500 / 10 = $795

3-4 Comparison Table of Three Contract Types

| Instrument | Contract Unit | 0.1 Lot Nominal Value | 1:30 Margin |

|---|---|---|---|

| EUR/USD | 100 k | 11,050 USD | 368 USD |

| XAUUSD | 100 oz | 19,500 USD | 650 USD |

| BTCUSD | 1 coin | 26,500 USD | 884 USD |

Ⅳ. My Zero-Dependency Margin Calculator

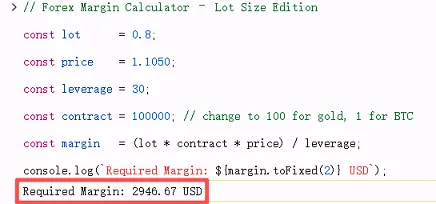

Copy the following lines of code and paste them into your browser's Console cursor. Press Enter to get the result:

// Forex Margin Calculator – Lot Size Edition

const lot = 0.8;

const price = 1.1050;

const leverage = 30;

const contract = 100000; // change to 100 for gold, 1 for BTC

const margin = (lot * contract * price) / leverage;

console.log(`Required Margin: ${margin.toFixed(2)} USD`);

Screenshot of console output:

Therefore, this website's calculator is simple, efficient, fast, and 100% open-source. You can view all calculation logic in the raw source code of the calculator page. None of our calculators record your private data; they run entirely within your own browser without uploading to servers.

Ⅴ. Margin Level: Why did my account get liquidated after opening just 0.1 lots?

Assume your account status is: Balance 10 k USD, Used Margin 3 700 USD (1 lot EUR/USD), Unrealized Loss -500 USD:

| Indicator | Calculation | Value |

|---|---|---|

| Equity | 10,000 – 500 | 9,500 USD |

| Free Margin | 9,500 – 3,700 | 5,800 USD |

| Margin Level | 9,500 / 3,700 × 100 % | 256 % |

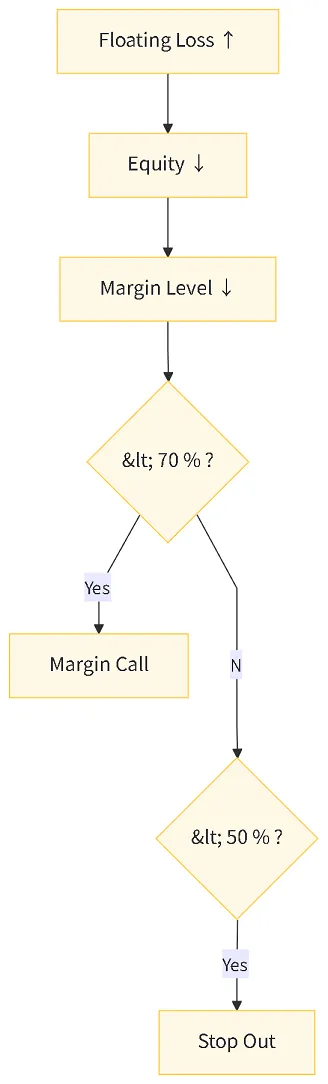

If the market moves another 200 pips against you, increasing the floating loss to -2,500 USD, the Margin Level drops below 70%. At this point, the broker will send you a Margin Call email. If it continues to fall to 50%, a forced liquidation will be triggered.

Conclusion: Maintaining over 50% Free Margin is the baseline. On the day my account was liquidated, it reached 48% and triggered a forced liquidation.

Ⅵ. Seven Questions and Answers (FAQ Page Markup)

Q1. Is higher leverage more dangerous?

A. Yes. 1:500 reduces margin to 0.2%, but a 0.2% adverse price movement triggers margin call.

Q2. Why is gold margin higher than forex for the same 0.5 lot?

A. Gold contracts are 100 oz. At $1,950 → nominal value $195k, far exceeding forex's $50k.

Q3. Can I use your calculator for stock indices?

A. Yes, simply replace contract size with the index's equivalent value (e.g., US30 = 1 USD × index points).

Q4. Do overnight swaps affect margin?

A. They do not affect already allocated margin but will reduce your Free Margin.

Q5. Is a 0.01 micro lot truly safe?

A. Relatively safer, but stop-losses remain essential; a 0.01 lot at 1:30 leverage requires approx. 37 USD margin, allowing for a maximum 370-pip fluctuation (on a 10k account).

Q6. Do cross pairs require double conversion?

A. Only when your account currency is neither the base nor quote currency; e.g., trading EUR/GBP in a USD account requires the EUR/USD rate.

Q7. Can your calculator code be embedded in WordPress?

A. Copy it into the "Custom HTML" block—zero API, zero cookies, GDPR compliant.

Ⅶ. Risk Warning

High-Risk Warning: Foreign exchange and leveraged products are speculative and can result in losses exceeding your initial deposit. The examples on this page are for educational purposes only and do not constitute investment advice. Always use regulated brokers and never risk more than you can afford to lose.

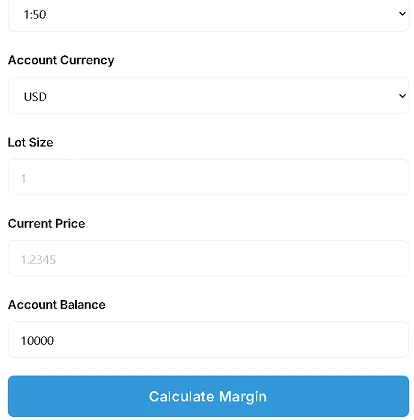

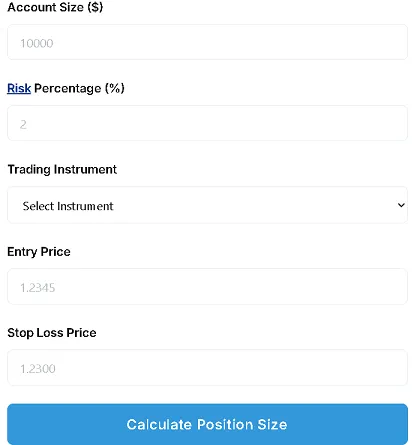

Ⅷ. Experience the Ad-Free Version Now Margin & Lot Size Calculator

Required inputs: Currency Pair, Trade Type, Leverage, Account Currency, Lot Size, Current Price, Account Balance

Calculates three fields: Required Margin, Free Margin, Margin Level

This calculator has no backend, no cookies, no logs, saves no private data, and uploads nothing to servers. All data resets upon page refresh. Maximum privacy protection.

(Click the link to the calculator pages: Margin Calculator or Position Size Calculator)

Ⅸ. Author's Notes: My Perspective and Personal Bias

In my view, "calculating margin and lot sizes" is a fundamental skill for traders. Unfortunately, 80% of beginners outsource this task directly to their platforms. I still vividly recall that margin call night in 2019: I received the Margin Call text while showering, covered in soap suds. Yet I knew exactly who was messaging me at that hour. Without a second thought, I grabbed my glasses, flashed open the trading app, and watched helplessly as my account plummeted from 8k to 4k in just 15 minutes—not because my position was wrong, but because I had no clue how much margin I was actually using.

That night, I calmed myself down and worked through the night to create the first version of the Excel spreadsheet—the prototype of the calculator you see today.

I'm not a finance major, nor do I hold a CFA. I'm just an ordinary webmaster and retail trader. But I understand this: breaking complex concepts down into steps even elementary students can grasp—that's where the real value lies. That's why I refuse to add "flashy" real-time quotes to the calculator. Because—

1. Most beginners won't use them, and they'll slow down the site.

2. Compliance risks skyrocket.

3. Slow loading actually hurts the user experience.

If after reading this article you can mentally calculate the margin required for a 0.2 lot position in 10 seconds, I've achieved my goal.

The rest is up to the market and your discipline. May you never face a margin call!

References :

ESMA leverage restriction guideline, 2025

Leave a Comment: