(You can click here to the Compound Interest Calculator page, or read this guide)

Introduction: Why Do You Need a Compound Interest Calculator? (A Real-Life Cautionary Tale)

Hello, I'm Qaolase, the creator of this financial calculator website and a trader who has stumbled upon the investment path just like you. Today, I want to talk about the compound interest calculator—a seemingly simple tool that could transform your financial future.

Remember back in 2023 when I got an email from user John? He nearly mortgaged his house to invest all-in on crypto due to a calculation error. He mistyped an 8% annual interest rate as a monthly rate, and the calculator showed he'd make 21 million after 30 years! But the truth? After factoring in inflation and fees, the actual gain was just 860,000. This kind of "mathematical illusion" leads countless ordinary traders to make dangerously misguided decisions every day.

Don't worry—this article won't scare you off with complex formulas. I'll use real-life examples + foolproof tutorials to guide you step-by-step through mastering compound interest calculations. Whether you aim to double your retirement savings through crypto dollar-cost averaging or simply wonder "how much will $500 monthly savings yield by retirement," the free calculator in this article (yes, that simple yet reliable compound interest tool on this site) will give you the answer.

I. The Core Principle of Compound Interest: The Golden Triangle of Time × Frequency × Additional Investments

1.1 Time: Start 10 Years Earlier, Shorten Your Struggle by Half a Lifetime

The harshest truth about compound interest is: time gaps cannot be compensated by principal alone. Consider these two sets of data:

Trader A, age 25: Saves $300 monthly at 8% annualized;

Trader B, age 35: Saves $500 monthly at 8% annualized;

By age 65:

Trader A's total investment: $144,000; Final principal + interest: $1,040,000;

Trader B's total investment: $180,000; Final principal + interest: $734,000;

Tip: If you're over 25, do these two things immediately:

1. Open the compound interest calculator page, input your parameters, and start calculating.

2. Set the result screenshot as your phone wallpaper—a daily reminder of "the cost of procrastination."

1.2 Frequency: Daily vs. Monthly Compounding—A Difference Worth a Car

Think identical annual rates yield identical results? Think again! The same $10,000 investment at 5% annualized yields astonishing differences under varying compounding frequencies:

| Compounding Frequency | Final Value After 5 Years | Difference |

|---|---|---|

| Annual Compounding | $12,763 | Base |

| Semi-Annual Compounding | $12,801 | +$38 |

| Quarterly Compounding | $12,820 | +$57 |

| Monthly Compounding | $12,834 | +$71 |

In the cryptocurrency space, Daily Compounding yields even more dramatic results: For ETH staking at 6% annualized, daily compounding earns 13.7% more than monthly compounding (equivalent to an extra $1,370 over 5 years).

Action Guide:

1. Select "Daily" in the calculator's "Compounding Frequency" field ;

2. If your investment platform pays interest weekly, select "Weekly" instead—this boosts returns by 3-5%;

1.3 Monthly Contribution: The Core Engine Underestimated by 99% of Investors

Formula Breakdown (Don't worry! This is the only time I'll explain it):

FV_total = P·(1 + r/n)^(n·t) + M·[ ((1 + r/n)^(n·t) − 1) / (r/n)]

Confused? See real examples:

Scenario 1: $100,000 principal + $0 monthly contribution, reinvested for 30 years at 8% annual return = $1,006,000

Scenario 2: $0 principal + $500/month contributions, 30-year compounding, 8% annual return = $745,000

Scenario 3: $10,000 principal + $500/month contributions, 30-year compounding, 8% annual return = $1,130,000

Key takeaway:

Monthly payments contribute a staggering 92% to the final total amount ($686,000 vs $59,000 principal growth).

This demonstrates that when your initial principal is below $50,000, focusing on increasing monthly payments is more effective than saving more principal.

II. Tool Usage Guide: Avoid 90% of Trader Pitfalls

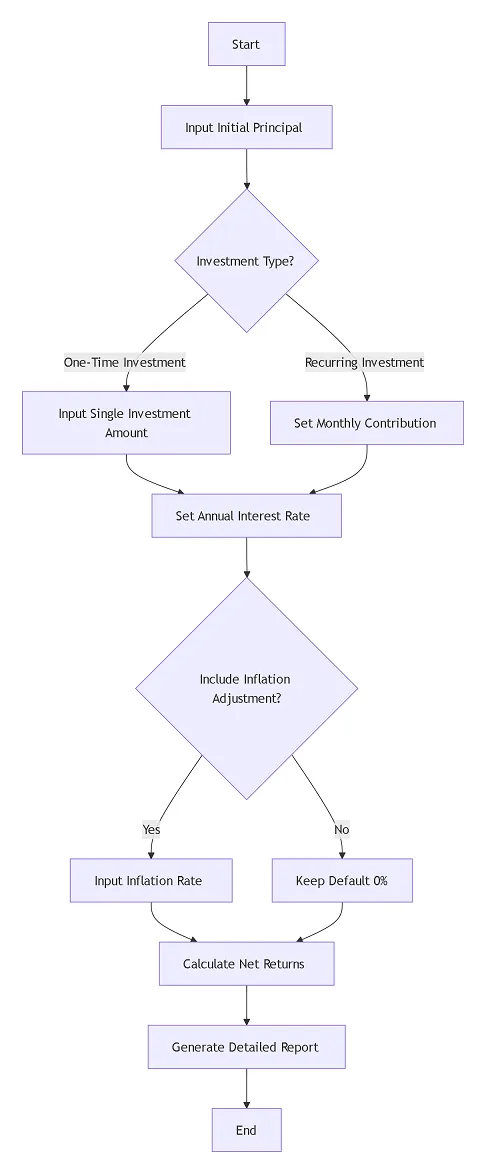

2.1 Step-by-Step Flowchart

2.2 Three Critical Mistakes Checklist (with Solutions)

Mistake 1: Overestimating Interest Rates

Typical Symptom: Projecting future returns based on 2021 cryptocurrency historical rates (e.g., 30%)

Real-world Example: Bitcoin's 10-year average return is 11.5%, yet 2025 staking rates are only 5-8% (Bloomberg data)

Solution: Apply conservative parameter rules

US Stocks: Input 6-7%

Cryptocurrency: Input 8-10%

Treasuries/Fixed Deposits: Input 3-4%

Mistake 2: Ignoring Transaction Costs

Hard-Learned Lesson: A DeFi platform advertised "12% annualized returns" but concealed hidden costs:

2% platform fee

20 Gas fees per transaction (if compounded monthly, annual transaction costs reach 240/year)

Actual return = (12% - 2%) - 240/principal. Assuming an initial principal of $5,000, the real effective rate ≈ is 5.2%.

Tip: Directly subtract total costs from the interest rate field. For example, if the advertised rate is 12%, you should actually input 5.2%.

III. Multi-Scenario Applications: From Cryptocurrency to Retirement Planning

3.1 Cryptocurrency Dollar-Cost Averaging Guide

Golden Formula Parameters:

Initial Principal ≤ 10% of liquid assets

Interest Rate = Platform's advertised rate × 0.7 (safety factor)

Monthly Contribution ≤ 5% of monthly income

Real-World Case Study (2020-2025 Bitcoin Dollar-Cost Averaging):

| Strategy | Total Investment | 2025 Balance |

|---|---|---|

| $500 monthly investment | $30,000 | $54,372 |

| $30,000 lump-sum investment | $30,000 | $48,150 |

Key Finding: Consistent long-term investing yields higher returns in volatile markets (e.g., if one purchase occurs at a peak, the next may occur at a trough, lowering the overall investment cost)

3.2 "Inflation Defense Strategy" for Retirement Planning

Three-Step Approach:

1. Calculate the funding gap:

Current age: 40

Target Retirement Fund: $1 million (in today's purchasing power)

Existing Savings: $200,000

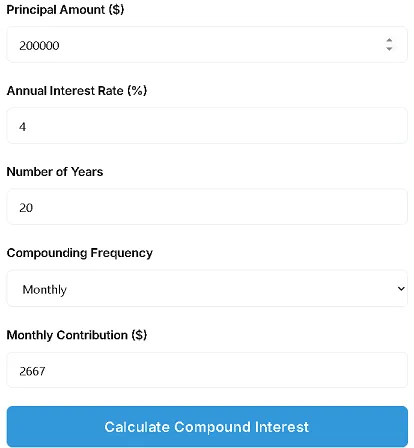

2. Access the website's compound interest calculator page and input:

Annual Interest Rate = Expected Return 7% - Inflation Rate 3% = Input 4%

Monthly Contribution = (1,000,000 - 200,000) / 300 months (25 years) = $2,667/month

Other values can be entered as appropriate.

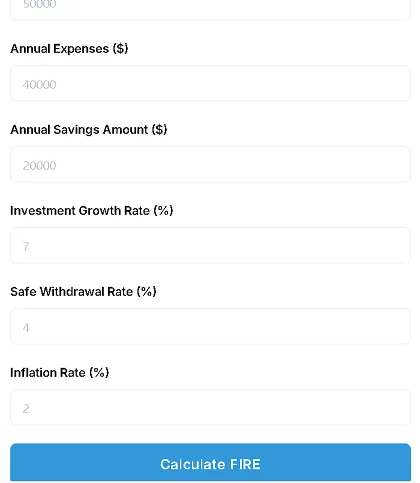

Tool Integration Tip: First, use the Compound Interest Calculator to determine the total amount, then use the FIRE Calculator to verify retirement feasibility.

IV. Risk Warning: Math doesn't lie, but markets do.

4.1 Three phrases you must see at all times: Keep these in your wallet, on your computer screen, and commit them to memory:

"Results are based on historical data modeling and do not constitute investment advice. Securities investments may result in loss of principal. — SEC Investor Alert Statement"

"Past performance ≠ future results — especially for cryptocurrencies"

"High returns come with high risk — be wary of returns exceeding 8%"

4.2 Volatility: The Invisible Killer of Compound Interest

The mathematical truth about volatility: Actual annualized return = Average return − 0.5 × (Volatility squared)

Example: A cryptocurrency with an average return of 15% and volatility of 40% → Actual annualized return is only 15% - 0.5 × (0.4²) = 7%

Correct Strategy: Input the "volatility-adjusted final return rate" (e.g., change 15% to 7%) in the Annual Interest Rate field of the calculator.

V. Free Tools + Advanced Techniques

5.1 Our calculator's algorithm is fully transparent. You can view the calculation process by inspecting the webpage source code on the compound interest calculator page, e.g.:

// Core compound interest code (feel free to inspect)

function calculate() {

let total = principal;

for (let i = 0; i < years * frequency; i++) {

total = total * (1 + rate / frequency) + monthlyContribution;

}

return total;

}

5.2 Rule of 72 Quick Reference Table

| Return Rate | Years to Double Principal |

|---|---|

| 4% | 18 years |

| 6% | 12 years |

| 8% | 9 years |

| 12% | 6 years |

Conclusion: The best time to plant a tree was 10 years ago—it's already mature now. The second-best time is today—it will still grow to maturity in 10 years! Act now, and time will be your greatest ally!

1. Calculate Now: Use our compound interest calculator

2. Parameter Recommendations:

US Stock Investors: 6-7% interest rate, minus 3% inflation = 3.5%

Crypto Investors: 8-10% interest rate, minus 3% inflation = 6%

3. Set Annual Reminders: Add "Compound Interest Checkup Day" to your phone (I set mine on my birthday)

"Compound interest is not magic; it is the honest observance of the laws of time." —Warren Buffett

Leave a Comment: