Click Position Size Calculator to use the Calculator, or read this guide.

Hey, buddy! Ever been in this awkward spot: you open MT4, ready to place an order for EURUSD, but suddenly realize you don't know whether to go with 0.1 lots or 0.3 lots? Worried that too small a position size won't generate enough profit, yet afraid that too large a position could wipe out your account in one stop loss?

Don't worry—today I'm pulling out my secret weapon: a completely free online "forex profit calculator lot size" tool, plus an ultra-detailed guide.

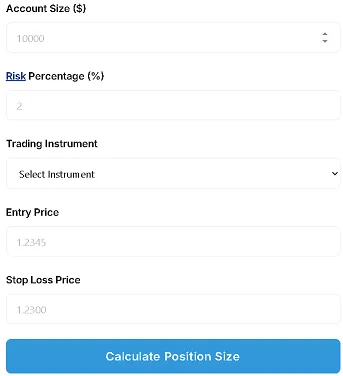

All you need are four numbers: your account balance, the percentage risk you're willing to take, your entry price, and your stop-loss price. Click a button, and the answer appears instantly. Even better, this calculator runs entirely in your browser—no personal data collection, no sneaky pop-up ads, and it loads instantly even on slow, old computers.

My goals for this article are simple:

First, help you fully grasp the math behind "lot size";

Second, help you lose less and earn more in real trading.

To make it accessible for beginners, I've broken down all formulas to an elementary math level, while also offering advanced techniques for experienced traders—like factoring in transaction costs, slippage, and overnight interest.

After reading this, you'll not only master the calculator but instantly spot whether those “miracle trades” shared on Zhihu or Twitter are legit. Ready? Let's dive in!

Ⅰ. What Is a Forex Profit Calculator for Lot Size?

1. Definition & Formula

Don't let the term "lot size" intimidate you—it simply means "how much you buy at once." In forex, 1 standard lot = 100,000 units of the base currency.

If you're trading EURUSD, 1 standard lot equals 100,000 euros. Sounds huge, right? Don't worry—most of us trade mini lots like 0.01 or 0.05 lots.

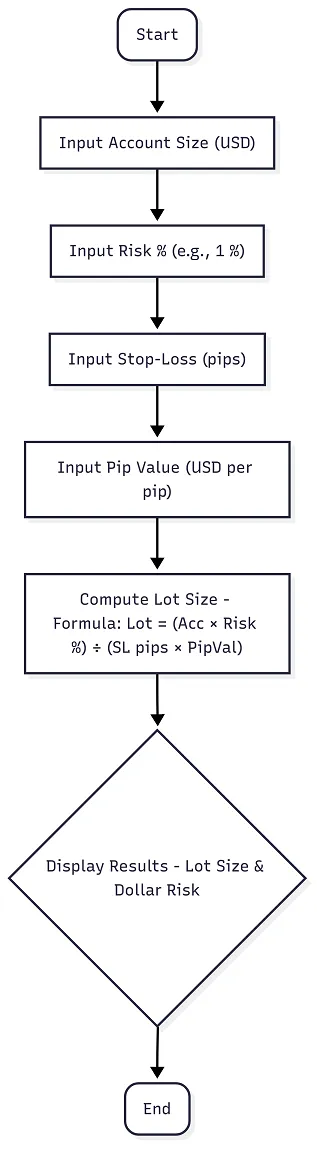

The core formula boils down to one equation:

Lot Size = (Account Equity × Risk%) ÷ (StopLoss_Pips × Pip_Value)

Let me break it down:

Account Equity is the current dollar amount in your trading account.

Risk% is the percentage of your account you're willing to risk per trade—typically set at 1%–2%.

StopLoss_Pips is the number of pips between your entry price and your stop-loss level.

Pip_Value is the monetary value per pip movement for a standard lot.

Example: With $5,000 in your account, you're willing to risk 1%, set a 50-pip stop loss, and EURUSD has a pip value of $10 per standard lot. Plugging in:

(5000 × 0.01) ÷ (50 × 10) = 0.1 lot. That's it!

Start: Input Account Balance → Input Risk Percentage → Input Stop Loss Points → Calculate Lot Size → End

2. Standard vs Mini vs Micro Lot Recap

Many beginners struggle with lot sizes. Here's a straightforward table:

| Lot Type | Unit Size (currency units) | Pip Value (USD) | Recommended Account Size |

|---|---|---|---|

| Standard Lot | 100,000 | $10 | ≥ $10,000 |

| Mini Lot | 10,000 | $1 | $1,000 – $10,000 |

| Micro Lot | 1,000 | $0.10 | < $1,000 |

If your account only has $300, never touch standard lots—0.03 lots (micro lots) are your only option. Don't ask how I know; it took two margin calls to learn my lesson.

Ⅱ. Why Traders Need a Risk-Based Lot Size Calculator

1. Protect Account Equity

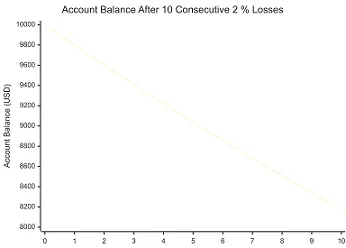

I've seen too many people go all-in right off the bat, only to have a single NFP move wipe their account back to square one. With the risk percentage method, you'll never let a single loss exceed 2% of your account balance. Even after 10 consecutive losses, you'll still have over 80% of your capital to recover.

X-axis: Number of Trades, Y-axis: Account Balance. After 10 consecutive 2% losses, 81.7% of account funds remain.

2. Meet the 1%-2% Risk Rule

1% or 2%? Conservative traders use 1%, aggressive ones use 2%. Personally, I use 1.5% in trending markets and drop to 1% in sideways markets. Remember, this rule isn't rigid—it's the baseline that lets you sleep soundly.

3. Avoid Over-Leverage

Leverage is like alcohol: invigorating in moderation, deadly in excess. EU ESMA caps retail accounts at 1:30, US CFTC at 1:50, while some offshore platforms offer 1:1000. Resist high-leverage temptations—your lot size calculator will reveal: no leverage ratio can rescue an overloaded position.

Reference: ESMA leverage restriction.

Ⅲ. Step-by-Step: How to Use Our Lot Size & Profit Calculator

1. Input Account Size

Enter your account's current "Available Margin," not the total equity. For example, if you deposited $5,000 and have a $200 unrealized loss, enter $4,800. Don't include profits—that's just "paper wealth."

2. Set Risk Percentage

Beginners should start at 1%. If you've won 20 consecutive trades and feel confident, you can raise it to 1.5%. Never jump to 5% just because "you feel lucky today." We must respect the market's power.

3. Select Instrument & Pip Value

The calculator includes pip values for 28 major currency pairs, plus gold, silver, and the US30. For less common crosses like EURSGD, manually input pip value using this formula:

Pip_Value = Contract_Size × 0.0001 ÷ Account_Currency_Rate

4. Enter Entry vs Stop-Loss Price

In MT4, simply draw a horizontal line to see the stop-loss points. Don't estimate visually—enter prices to five decimal places. A single pip difference means tens of dollars.

Ⅳ. Real-Trade Example

1. EURUSD – $10k Account – 2% Risk – 50 pips SL

Account: $10,000. Risk: 2% = $200. Stop-loss: 50 pips. Pip value = $10.

Lot Size = 200 ÷ (50 × 10) = 0.4 lots.

If target is 100 pips, profit is $400, RRR 1:2.

Table: EURUSD Trading Plan

| Item | Value |

|---|---|

| Entry | 1.08500 |

| Stop Loss | 1.08000 |

| Take Profit | 1.09500 |

| Lot Size | 0.40 |

| Risk | $200 |

| Reward | $400 |

2. GBPJPY – Same Account – 1.5% Risk – 80 pips SL

GBPJPY has higher volatility, with an 80-pip stop loss. Pip value = $9.25 (due to exchange rate fluctuations).

Lot Size = 150 ÷ (80 × 9.25) ≈ 0.2 lots.

Don't dismiss small lot sizes—a single profitable trade of $240 yields over 20% annualized returns.

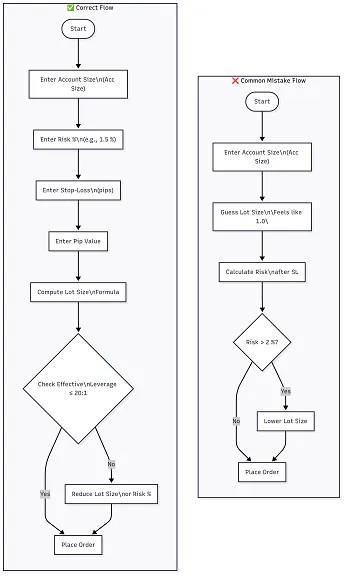

Ⅴ. Common Calculation Mistakes & How to Fix Them

JPY quotes have one extra decimal place: For GBPJPY at 150.123, Don't misread it as 1.50123.

Also, never overlook your account currency: If your account is in Canadian dollars, convert the pip value to CAD. Click here to access a professional pip value calculator.

My advice: When using a lot size calculator, factor the spread into your stop loss distance. For example, a 50-pip stop loss with a 1.2-pip spread leaves only 48.8 pips of actual risk.

Additionally, many novice traders fall prey to the leverage illusion. They assume higher leverage reduces margin requirements, even believing 1:500 allows full position sizing. Countless margin call cases prove this mindset is dangerous—most who adopt it end up with insufficient margin and forced liquidation.

Ⅵ. Deep-Dive Knowledge Bank

1. Three Bonus Knowledge Points at the End

Knowledge Point 1: Backward Calculation of Pip Value

When using a EUR-denominated account to trade USDCHF, pip value = 10 ÷ EURUSD exchange rate.

Knowledge Point 2: Contract Size Quick Reference

Crude oil futures are 1,000 barrels per contract—do not confuse this with forex's 100,000 units.

Knowledge Point 3: Drawdown Recovery Table

Five consecutive 2% losses require a 10.4% gain to recover.

Ⅶ. Troubleshooting & FAQ

Q1: Why do results differ from MT4 order windows?

Reason: MT4 defaults to including commissions. We added a “Commission Buffer” row below the output field to prompt users to manually deduct them.

Q2: How to place orders below 0.01 lots for micro accounts?

Some platforms support 0.001 lots. Our calculator allows 3 decimal places.

Ⅷ. Risk Warning & Responsible Trading

"Trading leveraged products involves a substantial risk of loss and may not be suitable for every investor. Past performance is not indicative of future results."

If you are a beginner, I strongly recommend:

Verify 20 trades using a demo account first.

Limit risk per trade to no more than 2%.

Withdraw half of the monthly profits at month-end.

Reference: CFTC Risk Disclosure

Ⅸ. Additional Free Tools & Next Steps

Common calculators: Pip Calculator, Margin Calculator, Risk/Reward Calculator.

Final Checklist Before You Hit Buy/Sell:

1. Verify risk % ≤ 2%

2. Confirm stop-loss placement is logical (above/below key level)

3. Ensure lot size aligns with calculator output

4. Confirm free margin ≥ 150% after order execution

5. Set take-profit at 1:2 RRR or trailing stop

Leave a Comment: